Wednesday, October 5th marks the 6th annual World Financial Planning Day. My favorite made-up day of the year 🙂 So what should you have in your financial plan?

When most people think of financial plan, they typically think of investing and retirement. These are definitely key aspects of a plan, but it SHOULD be much more.

[If you’d rather see a video with similar content, you can view it here].Here are 6 critical things any comprehensive financial plan should have:

Goals and purpose

Cash Flow Analysis

Investments

Tax Planning

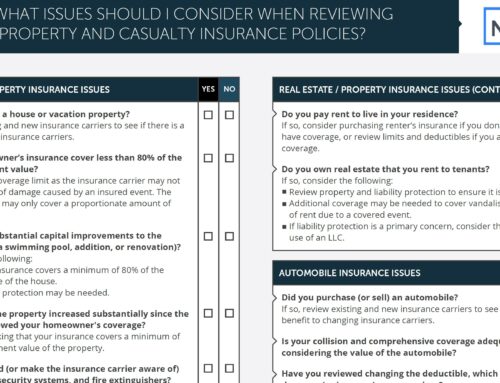

Insurance and Risk

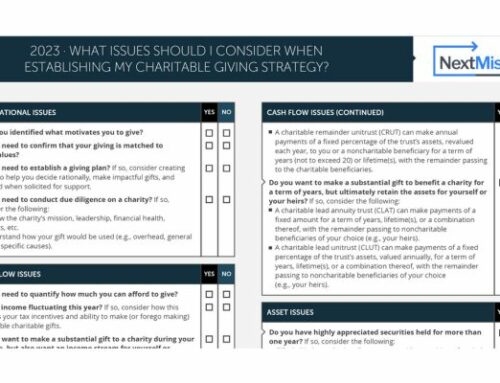

Estate Planning

The foundation of any plan is your goals and the purpose for the money you are earning, saving, and investing. As I’ve written before in Less Wrong Tomorrow, you won’t get this 100% right. Goals change and evolve, but you need a target to shoot at so you can get it directionally correct.

Viewing your cash flow through the lens of your goals and purpose can be an enlightening exercise. Aligning these can help your financial health and overall wellness.

Investments can help facilitate the long-term goals you’ve identified. The primary thing a good investment plan does is to link the goals, and the time frame to achieve those goals with the risk tolerance of the investor. At this point, you can determine what investments or products will meet those needs. A misalignment here can lead to disaster.

Taxes can rival housing as the largest bill you pay each year. Multi-year tax planning has the ability to significantly improve your financial health. While it might be counterintuitive to some, it is NOT always best to pay the minimum amount of taxes each year. The goal is to pay the minimum amount of taxes over your lifetime (and with estate planning multiple generations). We want to pay all the taxes we owe, but not leave the IRS a tip!

Risk and insurance are intertwined. We typically use insurance to mitigate the risk of a large potential cost that has a low probability of occurring. We pay a smaller amount of money to an insurance company that can pool our funds with other policyholders. Understanding your risks and the people who rely on you for support should be used to determine your risk profile. At this point, you can build a strategy to purchase the right amount and type of insurance.

Although it isn’t the most fun thing to think about and unless we get some incredible medical advance, everyone eventually dies. Your estate plan determines what happens with your assets and your stuff. As the band Rush sings, “If you choose not to decide, you still have made a choice.” If you die without a will in place, the state will determine how to divide your assets. This may or may not be what you wanted.

The relative importance of these topics may shift over time. There may be a season where ensuring you can meet your goals for a child’s education is the priority and then another when retirement plans or your legacy becomes the top concern. That happens as we transition through the phases of life.

Is your plan still on track after the brutal market of 2022? Do you need to build or refresh an aspect of your plan? If so, consider scheduling a meeting with me (here) if you’d like to understand how I might be able to help you.