Latest Posts

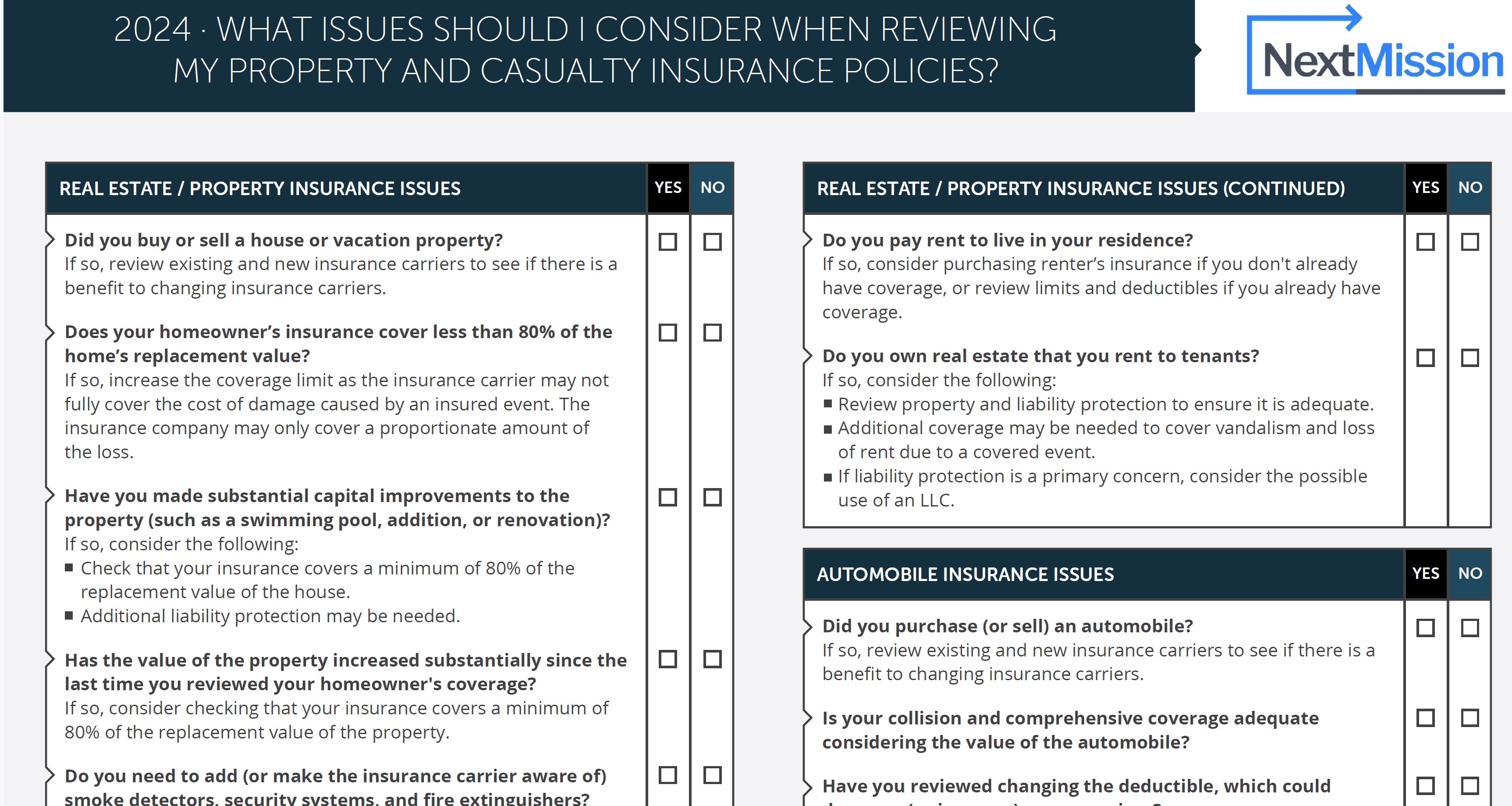

Conducting A Home and Auto Insurance Review

Conducting a Home and Auto Insurance Review Many consumers are shocked when they receive their annual insurance bills. Rates for

Student Loan Repayment

Student Loan Repayment As of the end of December, nearly 40% of federal student loan borrowers had missed at least

The Co-Owner of Your Traditional 401K, IRA, & TSP Accounts

The Co-Owner of Your Traditional 401K, IRA, & TSP Accounts You may not realize it while you’re working to build

Avoid These FAFSA Mistakes

FAFSA Mistakes To Avoid It's FAFSA Time! Last month, the Department of Education confirmed that the long-awaited new and improved

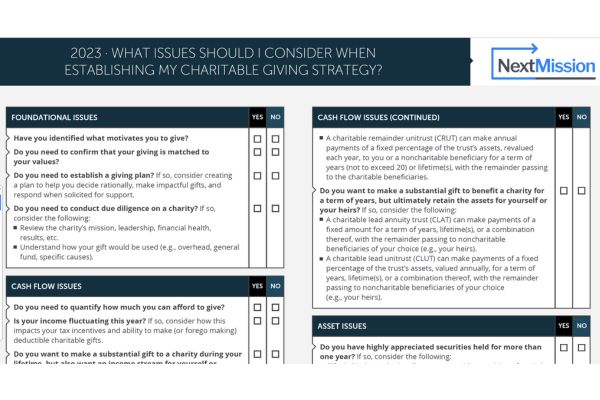

Don’t Give Cash To Charity

Don’t Give Cash To Charity…Do This Instead Charitable giving is a powerful way to make a positive impact on the

Paying for Long-Term Care

Paying for Long-Term Care: A Comprehensive Guide In part one of our series on Long-Term Care (LTC), we talked about the

Planning

Conducting A Home and Auto Insurance Review

Conducting a Home and Auto Insurance Review Many consumers are shocked when they receive their annual insurance bills. Rates for

Don’t Give Cash To Charity

Don’t Give Cash To Charity…Do This Instead Charitable giving is a powerful way to make a positive impact on the

Paying for Long-Term Care

Paying for Long-Term Care: A Comprehensive Guide In part one of our series on Long-Term Care (LTC), we talked about the

Long-Term Care

Long-Term Care: Why Everyone Needs A Plan Introduction October is Long-Term Care (LTC) Planning Month. While no one likes to

Social Security Case Studies: Claiming for Couples

Social Security Case Studies: Claiming for Couples Planning for retirement involves numerous decisions, and one of the most significant factors

Social Security For Couples

Social Security For Couples: Spouse and Survivor Benefits Planning for retirement involves numerous decisions, and one of the most significant

Saving & Investing

The Co-Owner of Your Traditional 401K, IRA, & TSP Accounts

The Co-Owner of Your Traditional 401K, IRA, & TSP Accounts You may not realize it while you’re working to build your nest egg and enjoying the annual tax break, but

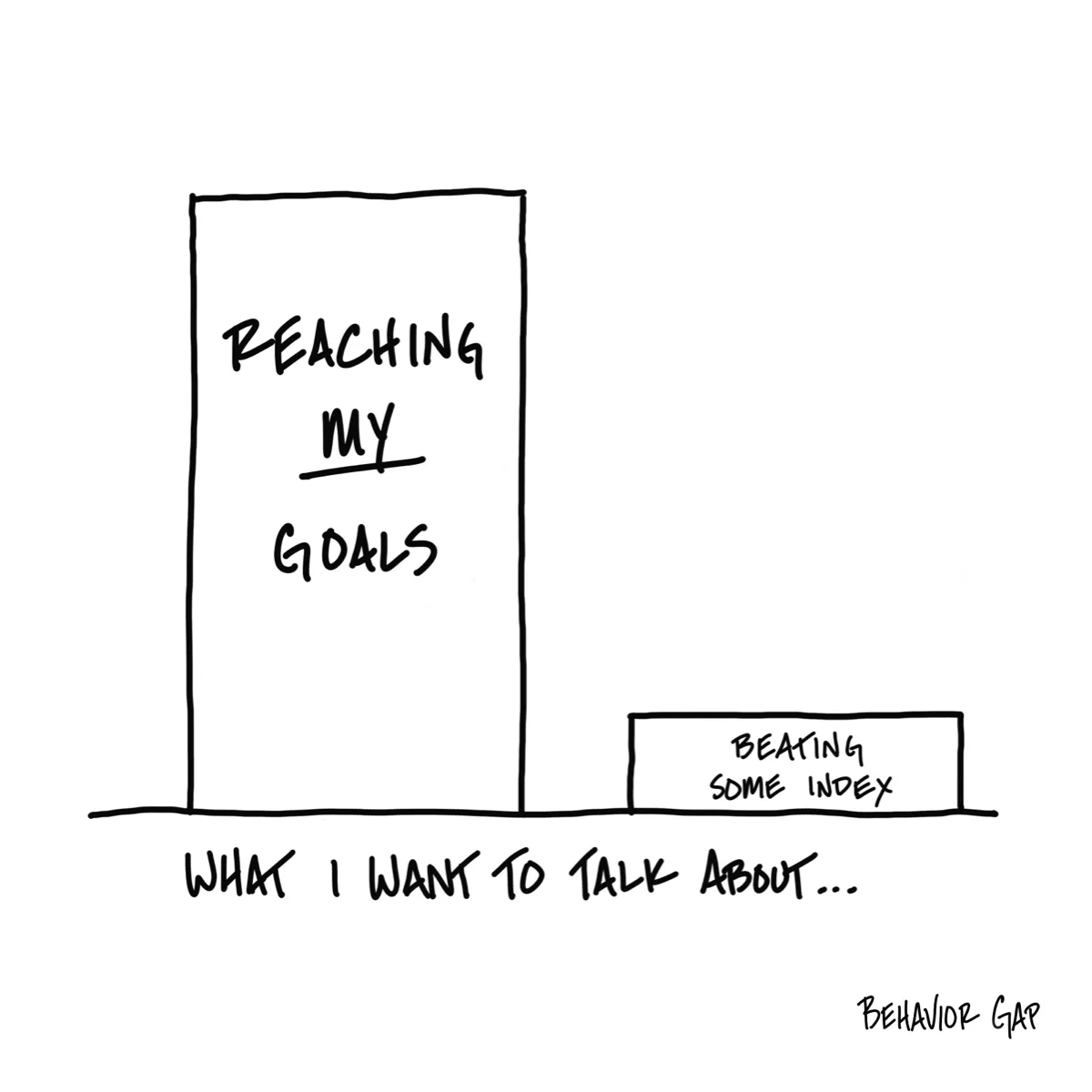

Beating Some Index

Beating Some Index In personal finance, what matters is not beating some index. What matters is meeting your goals. Too often the investment industry confuses the two. An index is

Start Them Early – Roth IRA For Kids

Start Them Early - Roth IRA For Kids “Compound interest is the 8th wonder of the world”. While there is little evidence that Einstein actually said this, compound interest is

Get The Big Things Right – Accumulation Phase

Get The Big Things Right - Accumulation Phase Personal finance, like most things in life, is subject to the Pareto Principle which says 80% of the results come from 20%

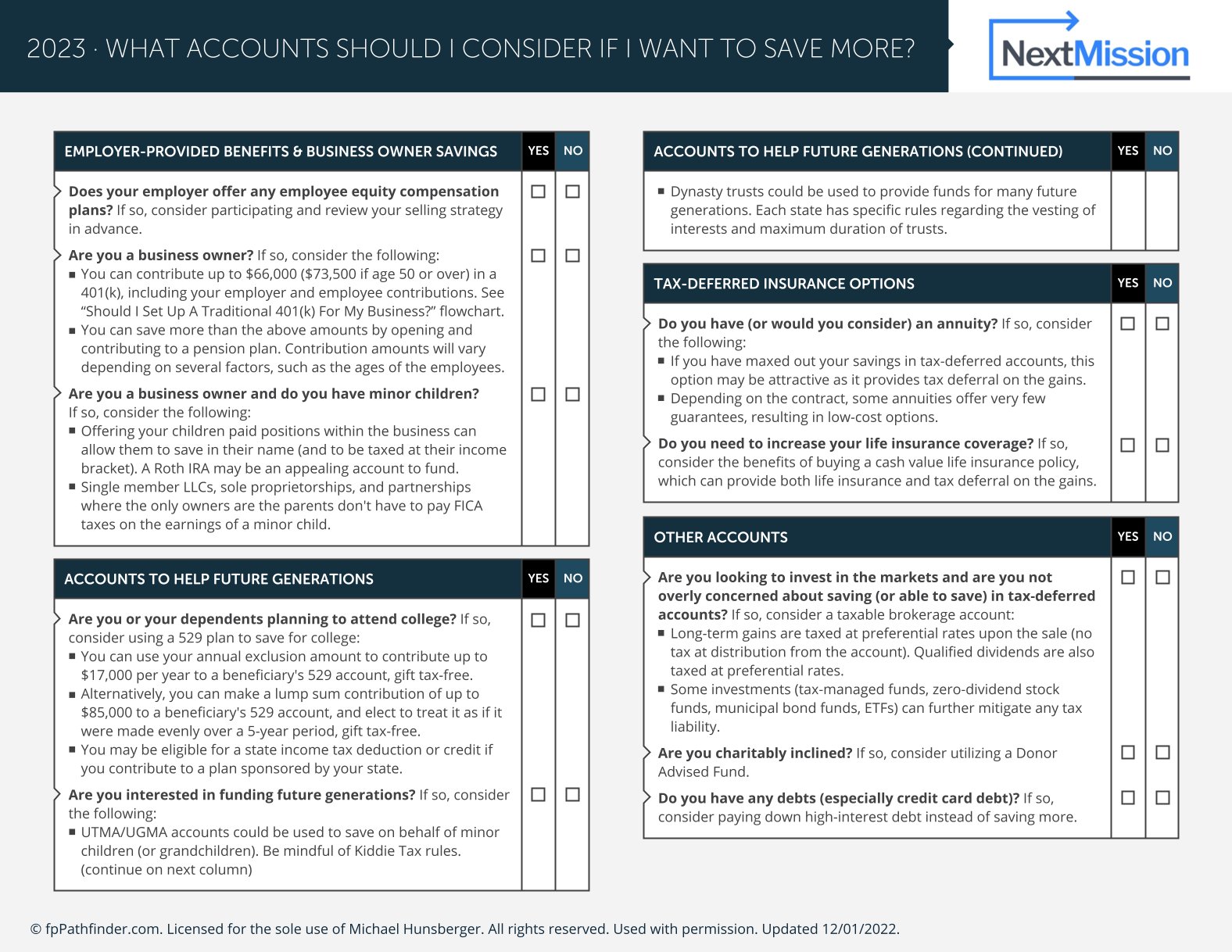

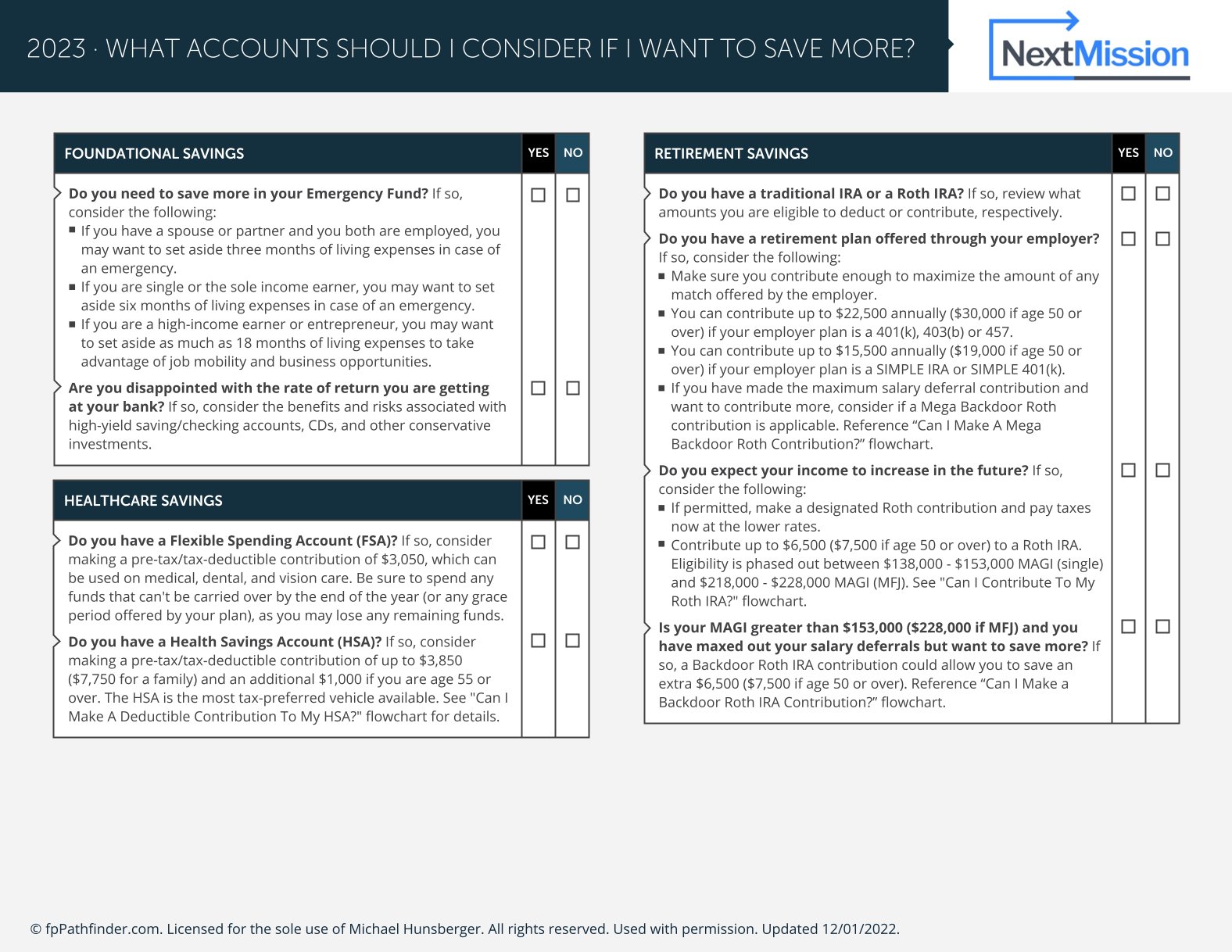

15 Ways To Save More [Checklist]

15 Ways To Save More During January and February, we like to help clients identify proactive ways to start the year off right and save more. Perhaps you… Received a

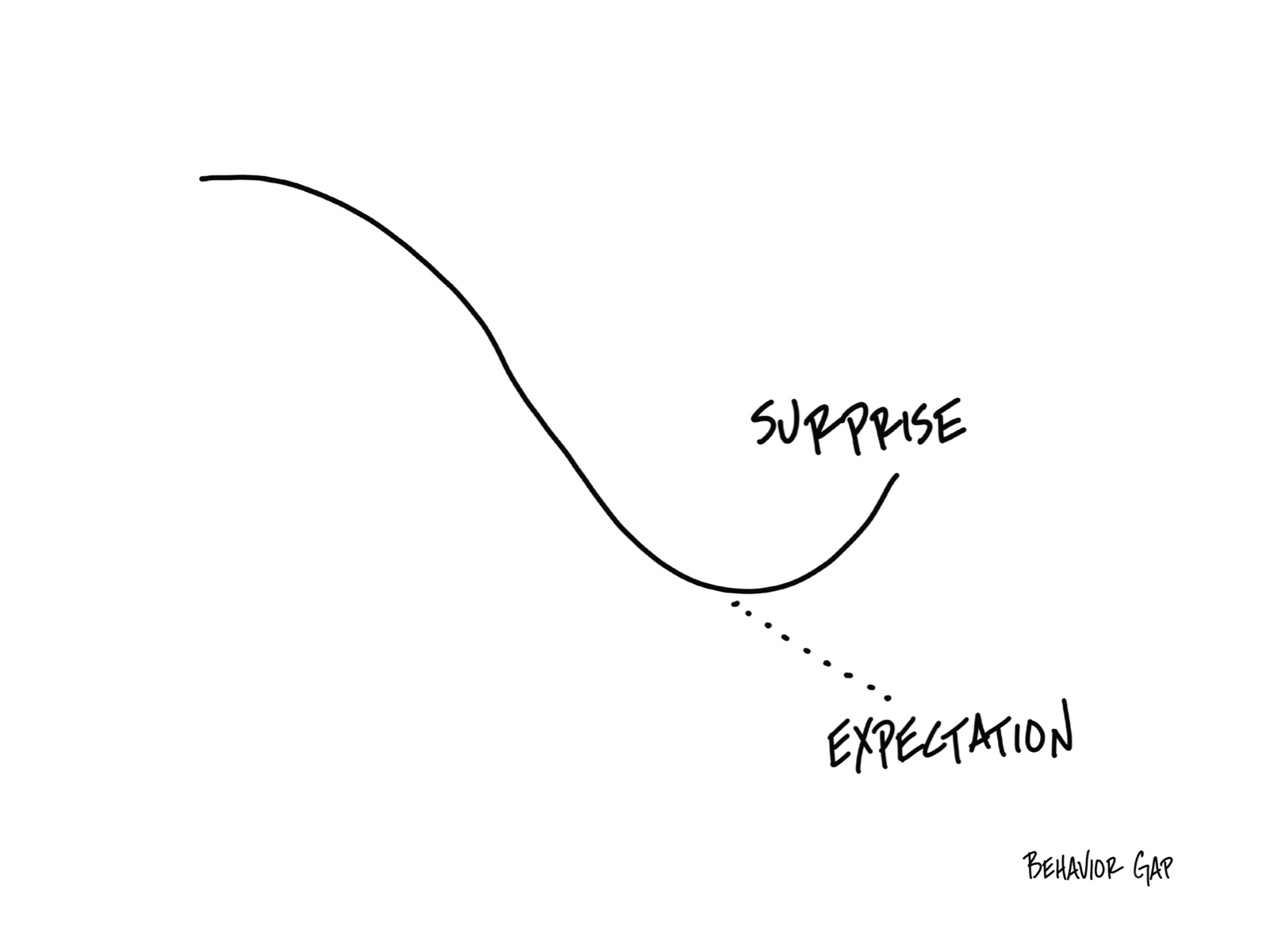

Loss Aversion

We feel the pain of loss more than we feel the pleasure from gain. Because of this, we try to avoid loss. This is called loss aversion.

College Planning, Saving, and Funding

Student Loan Repayment

Student Loan Repayment As of the end of December, nearly 40% of federal student loan borrowers had missed at least

Avoid These FAFSA Mistakes

FAFSA Mistakes To Avoid It's FAFSA Time! Last month, the Department of Education confirmed that the long-awaited new and improved

FAFSA Changes

FAFSA Changes The Free Application for Federal Student Aid (FAFSA) is undergoing a major revision for the 2024-2025 and future

College Bound – Freshman and Sophomore Checklist

High School Freshman and Sophomore Checklist Preparing for College For students planning to attend college, starting off their high school

College Bound – Junior Year Checklist

College Bound - Junior Year Checklist A student’s Junior year in high school is arguably the most critical year for

College Ahead – Senior Year Checklist

Senior Year Checklist to Prepare for College It’s here…senior year. You’re child has worked hard and this will be the

Life

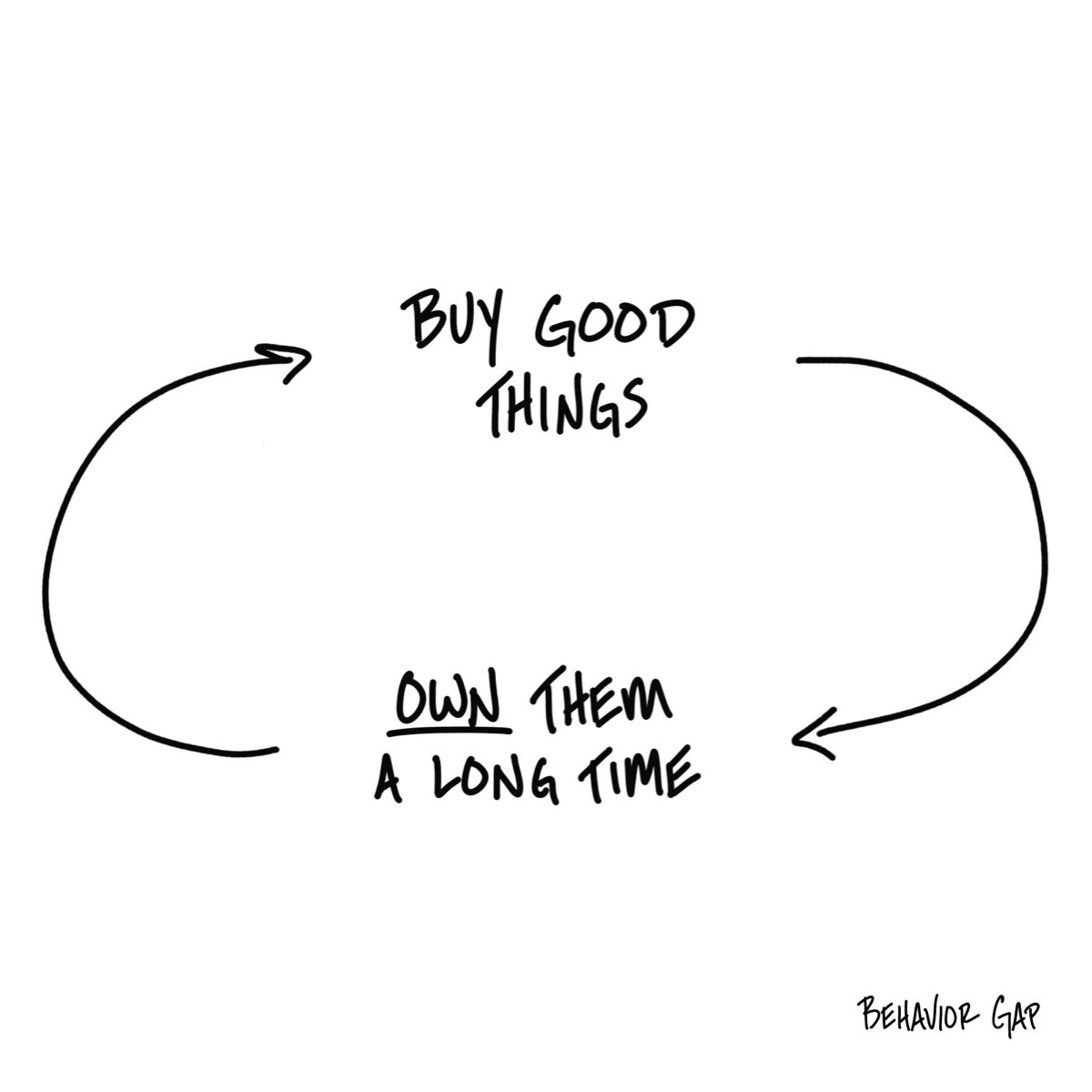

Buy Good Things…Own Them A Long Time

Buy Good Things - Own Them A Long Time Thrift or as some (my wife) might say being cheap, is

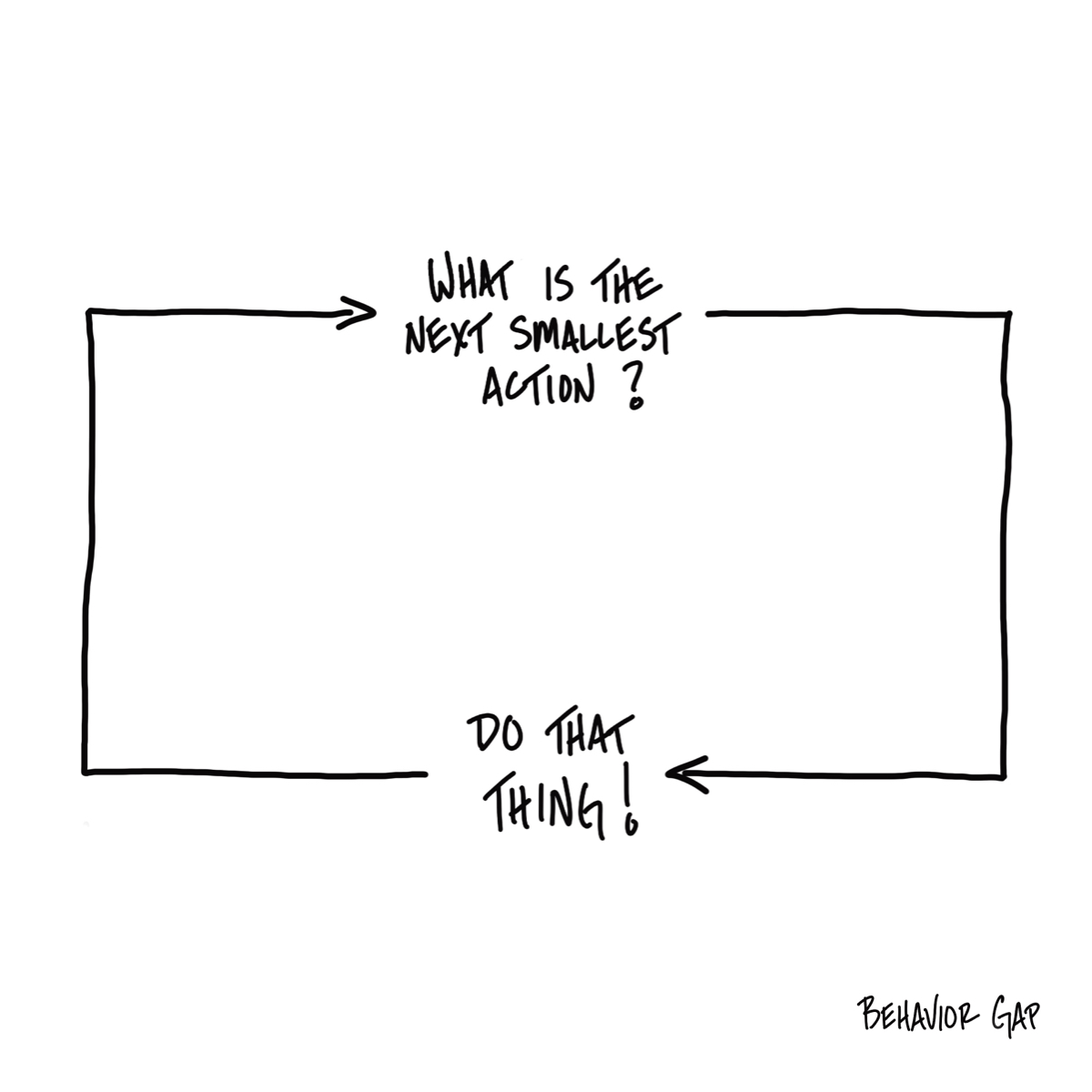

Next Smallest Step

Next Smallest Step Do you have big ideas about things you’d like to do? How often do actually complete them?

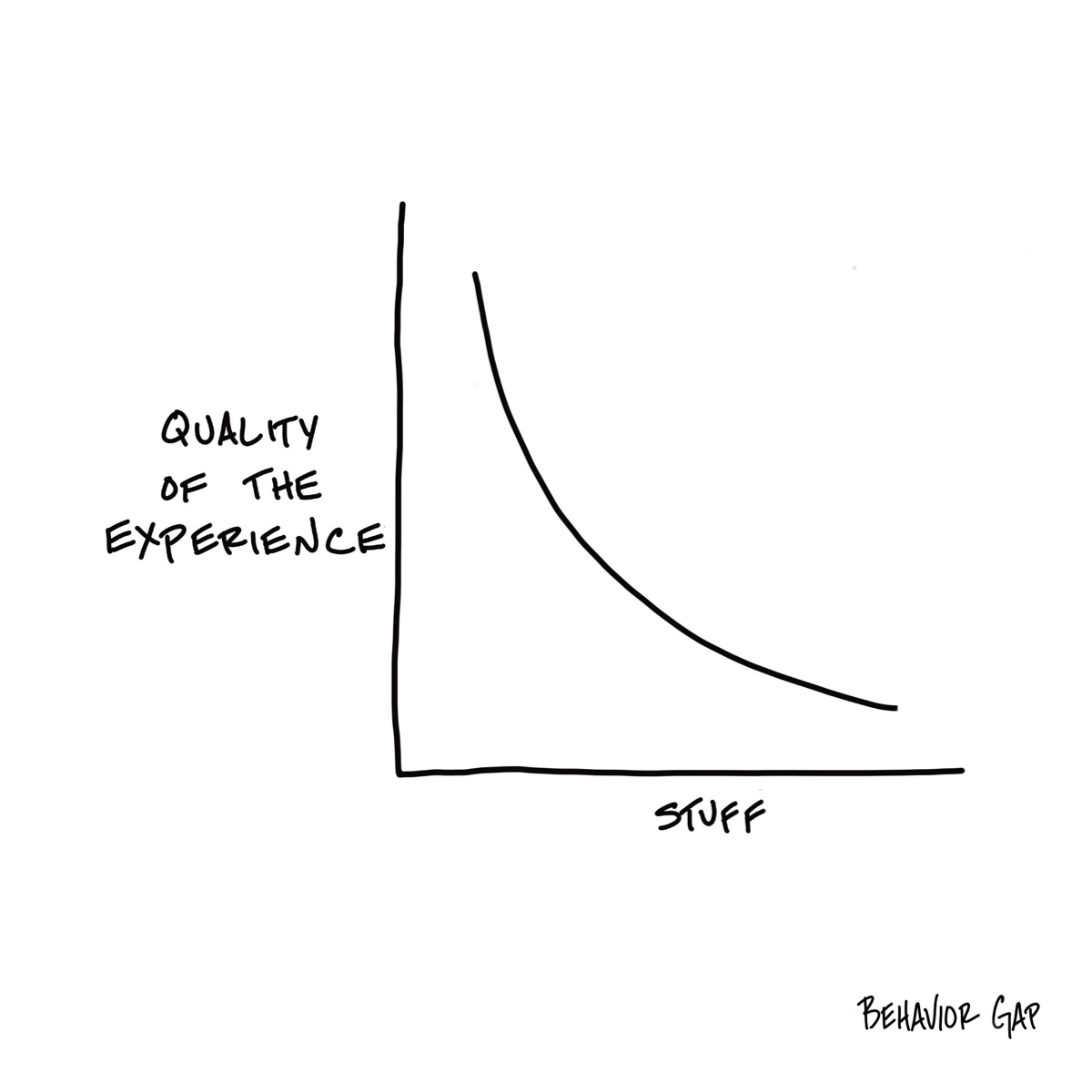

Alpine Style Living

I usually write something original when I post these images, but I really liked Carl Richard’s thoughts on extending alpine-style

Recency Bias

We are great at projecting what has happened recently will continue to happen in the future. This is also known as recency bias.

Your Future Self

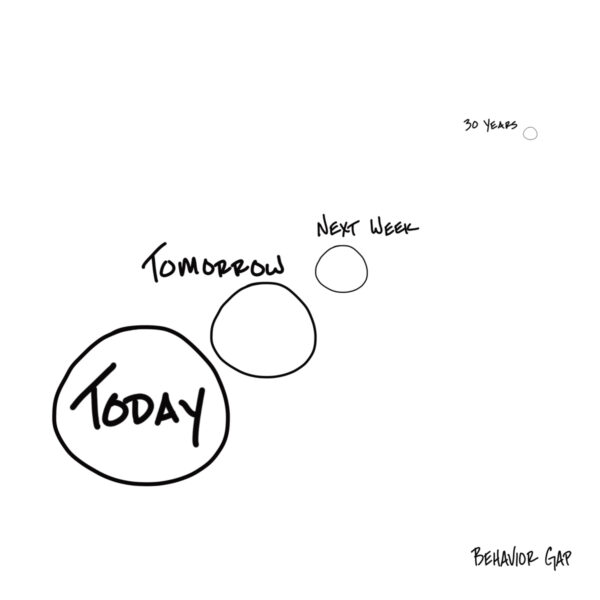

It's often hard to imagine our future self even in the near-term. Thinking about our future self is important.

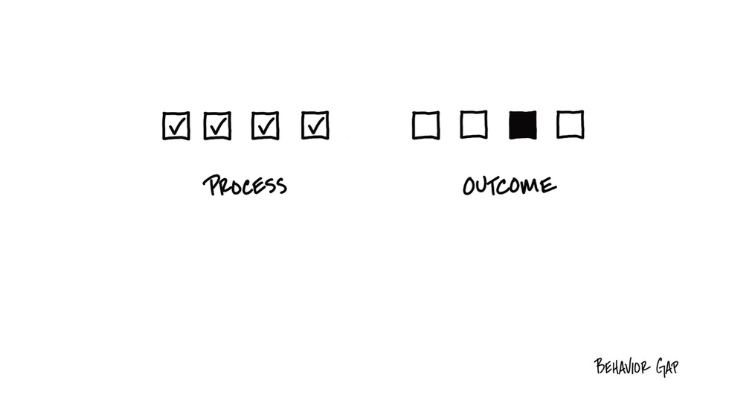

Process Over Outcomes

Process Over Outcomes Have you ever made a decision that didn't work out as you had planned or hoped? Did