Get The Big Things Right – Accumulation Phase

Personal finance, like most things in life, is subject to the Pareto Principle which says 80% of the results come from 20% of the effort. This means that if you get a few main principles right you can be successful. I’m going to do a series of these posts based on different seasons of financial life. Seasons like the accumulation phase, retirement red zone,education planning and ultimate retirement. If you have any ideas for other potential posts, please leave them in the comments.

The Accumulation Phase

Here are the top 5 things I tell people who are in the accumulation phase of life. The accumulation phase is for those who are still working toward financial freedom.

1) Spend Less Than You Make – This is the bedrock principle for wealth accumulation. Whether you need to budget to the penny or you just save or invest first and spend whatever is left doesn’t matter as long as it works for you. What’s important is the ability to avoid high-interest rate debt on credit cards and getting into a debt spiral.

2) Start Saving/Investing Early and Increase How Much You Save Over Time – Time is an incredibly important factor in investment returns. Starting to save as early as possible. If you haven’t started yet, today is better than tomorrow. Starting small is fine. Just increase it over time. The goal depending on when you start should be to get 15-20% of your salary. If you want to see a comparison of how much of a difference starting early can make, check out this blog post (Link).

3) Keep Your Investing Expenses Low – The number of ways that you can invest is really only limited by your imagination. Having all these options is great, but understanding how much you’re paying is critical. Too often I talk to prospects that have been sold or told to invest in high-cost products or funds. Paying too much will have a significant drag on your overall results. This is one of the great things about the standard TSP funds (S, C, G, F, I, and the Lifecycle funds). They all have low expense ratios. The low fees used to be unique to TSP, but the rise of index-tracking Exchange Traded Funds (ETFs) has made it easier to keep your expenses low in brokerage accounts and IRAs.

4) Build A Diversified Portfolio – As Nobel Laureate Harry Markowitz has said, “Diversification is the only free lunch in investing.” Spreading risk over multiple asset classes like stocks, bonds, real estate, or within an asset class like small cap, large cap, value, growth, or international stocks can actually improve returns over time while also lowering volatility.

5) Taxes Matter – I’ve written a post about this recently. Taxes can easily rival housing as your biggest lifetime expense. For very high earners, it can easily be the biggest expense. Step 1 is understanding your tax profile. Step 2 is having a plan to pay the minimum amount of taxes over your lifetime. It’s not just optimizing a single year. Reducing tax drag now and in the future can have a big impact on how much you get to keep.

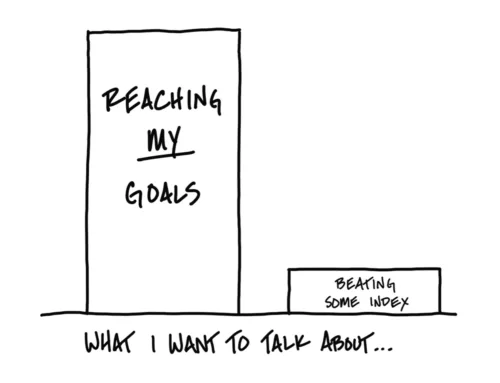

There are many things that impact financial health. Getting the big things right can improve your financial situation and help you reach your financial goals.