Die With Zero

Ronald Reed, a former gas station employee and janitor died in 2014. He left most of his $8 million to the local library and hospital. No one guessed he was worth anywhere near that amount of money. Good came out of it, but I can’t help but think he could have participated in that good if he had given it away when he was still alive.

Mr Reed is an extreme case. But, our longer life spans mean the age at which people are inheriting money is also increasing. In 1989 the average age at which someone received an inheritance was 41. Today it’s closer to 51 and continuing to increase.

I believe money is a tool. It’s not a scorecard or something to be hoarded. It’s only useful when you exchange it for something you want or need.

I talked about where to save more with the checklist (LINK) I sent last week. I also said I’d talk this week about the fact that some people may not need to save more.

The Book

I’m a big fan of the book Die With Zero by Bill Perkins (LINK). A summary of his thesis is money is a tool. Additionally, as we go through the seasons of life what we want to do (or even can do because of health) will change significantly. Backpacking through Europe and staying at youth hostels is something to do in your 20s. You can go to Europe in your 60s, but it will be a different experience. Understanding these seasons should be a part of your planning. Putting everything off until retirement means many things probably won’t get done.

Intentionality is the key. There is little reason to die with millions of dollars sitting in an account somewhere. You’ve under-optimized. This doesn’t mean you shouldn’t give money to your kids or a favorite charity. You should be intentional about it and most of the time do it while you’re alive.

I read this book several years ago and it’s definitely shifted my thinking. I have been a perpetual saver since elementary school and an investor since I was doing my co-ops in college. These actions (and the military pension/health care) provided me the flexibility to start my business. The book also helped me to understand that I need to prioritize opportunities in each season of life and dedicate resources to them.

Deciding when and how you’ll use your resources is as important as building them. You may be thinking that’s great, but how do I know when to spend and when to save?

Here are a few questions to get you started:

- Where am I now?

- Where do I want to go?

- What will it take to get there?

- Am I on track?

- Am I ahead? If so maybe I don’t need to save more

One thing is for certain. All of this will change. What you want will change. Where you end up will change. That’s why it’s important to review this on a regular basis.

How to Approach Planning to Die With Zero

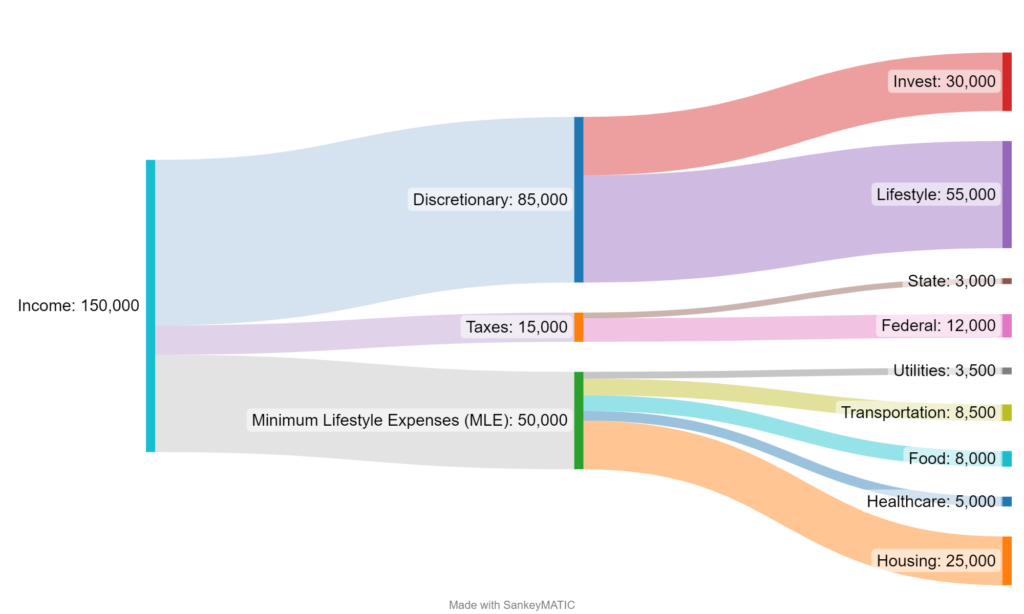

I like to break gross income (total amount coming in before taxes) into three categories: Minimum Lifestyle Expenses (MLE), Taxes, and Discretionary Income. Minimum Lifestyle Expenses are those things you need to meet your basic needs. This includes housing, utilities, transportation, healthcare, and food. MLE is important during the building phase, but it’s crucial during retirement when you don’t have a paycheck coming in. Structuring guaranteed income (pension, social security, annuities) to meet MLE during retirement can significantly reduce stress.

After MLE and taxes, remaining income is discretionary. You can either spend it to elevate your lifestyle or invest it for the future.

Here’s a notional example of what that might look like.

I find that many military retirees, especially senior officers, can cover their MLE with their retirement pay, any VA disability pay, and social security. The good thing about this money is that it is also indexed for inflation (assuming Congress continues to approve inflation adjustments for retirement/VA pay).

Any additional savings or investments can be used for travel or other experiences, to give to family or charity, or to improve your lifestyle.

Bottom line: Die With Zero is about being intentional with your money. It’s not saving and investing just to have an account with a larger number in it. The 87-year-old with $5,000,000 probably should have spent or given away more in their 50s, 60s, and 70s to enjoy life.