Financial Health Checkup

January is the perfect time to talk about financial wellness and to do a financial health checkup. I’ll show you how to assess where you are on your financial journey and look to the year ahead if you need to make any changes.

How To Do It

I love a good spreadsheet for recording this type of financial health information because it can allow you to reflect on the numbers over time to ensure you’re moving in the right direction. There are also numerous options on the web that help automate some of this. The key thing is to find something that meets your need and isn’t too complicated. If it’s too complicated you probably won’t do it.

What Should You Measure

There are several measures that can help you assess your personal financial health:

- Emergency fund: It’s important to have an emergency fund to cover unexpected expenses, such as a car repair or medical bill. A good rule of thumb is to have at least three to six months’ worth of living expenses saved in an emergency fund.

- Debt: Keeping your debt levels low is important for financial health. Look at the total amount of debt you have, as well as the interest rates on that debt. If you have high-interest debt, it may be a good idea to focus on paying that off first.

- Savings rate: It’s important to save money for the future, whether it’s for retirement, a down payment on a house, or other financial goals. A good way to measure your savings rate is to divide the amount you save each month by your net income (income after taxes). Aim to save at least 10% of your income and grow it over time.

- Credit score: Your credit score is a measure of your creditworthiness and can affect your ability to get a loan or credit card, as well as the interest rate you’ll pay. A good credit score is typically considered to be above 670.

- Budget: Creating and sticking to a budget can help you manage your money and make sure you’re saving enough. Make sure you’re not spending more than you’re earning, and try to reduce unnecessary expenses.

- Net worth: This is simply your assets minus your liabilities or what you own minus what you owe. I find this to be the best long-term health metric to track after you’ve completed the basics.

By keeping track of these measures, you can get a sense of your financial health and identify areas where you can improve. It’s important to regularly review your financial situation and make adjustments as needed.

Calculating Net Worth

This is my favorite measure to track over time to assess how I’m doing. Here’s a simple step-by-step guide to calculating your net worth:

- Make a list of all your assets, including any cash you have on hand, your investments (such as stocks, mutual funds, and bonds), any property you own (such as a home, rental properties, land, or a business). You can also include any personal possessions of significant value (such as jewelry or art). Be sure to include the current market value of each asset.

- Make a list of all your debts and liabilities, including any mortgages, student loans, credit card balances, or other types of loans. Be sure to include the outstanding balances and interest rates for each debt.

- Add up the total value of all your assets.

- Add up the total value of all your debts and liabilities.

- Subtract your total debts and liabilities from your total assets to calculate your net worth.

An example

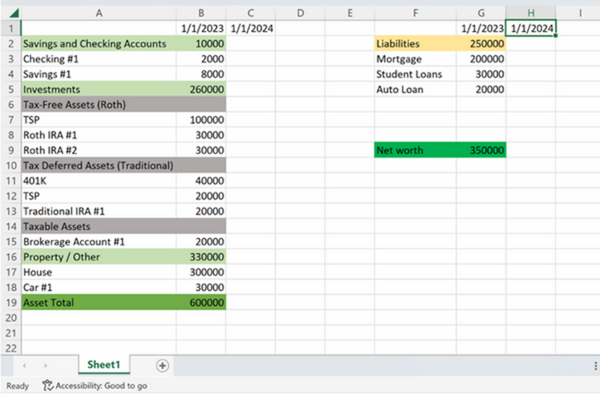

List of all your assets and their current value. For example:

- Cash and savings accounts: $10,000

- Investment accounts: $260,000

- Primary residence: $300,000

- Cars: $30,000

Total assets: $600,000

Make a list of all your debts and their balances and interest rates. For example:

- Student loans: $30,000 (4% interest rate)

- Mortgage: $200,000 (3.5% interest rate)

- Auto loans: $20,000 (5% interest rate)

Total debts: $250,000

To calculate your net worth, subtract your total debts from your total assets:

Net worth = $600,000 (total assets) – $250,000 (total debts) = $350,000

In this example, the person’s net worth is $350,000.

This is a simplified spreadsheet, but it only took me about 15 minutes to create. If you’re not tracking your net worth, consider creating a spreadsheet or searching the web for a version that will work for you.

Important Considerations

Net worth can fluctuate significantly as the value of assets or the amount of debt changes. When you just starting to build assets, how much you save can have a big impact on your net worth. As your assets grow, especially if they are invested in stocks or other risk assets, the return on those assets will have a larger impact.

I like to zoom out and view net worth over a several-year period and make sure the trendline is going in the right direction and not worry about short-term market fluctuations.

Again, keep in mind that your net worth can change over time as the value of your assets and debts changes. It’s a good idea to review your net worth regularly to track your financial progress and identify areas where you can make improvements.

Interesting in assessing your financial health with this short 8-question quiz (Link)?