Mid-Year Tax Review

I know you’re probably feeling like you just finished taxes, but as we head into the middle of the year it’s a good time to check your tax situation. Most people will review taxes near the end of the year. That is prudent. The bad thing about that is you’ve got a very limited time to make any changes. By conducting a mid-year tax review and formulating a plan now, you still have half the year to implement any changes.

Here are 7 things to check during your mid-year tax review to make sure your plan is on track:

Check Your Withholdings

Did you get a large refund or pay a large tax bill this year? Many people like to get that big check from Uncle Sam in March or April. It is nice, but it’s actually costing you money. Some high-yield savings accounts are paying 4% or more. A $3,000 refund could have earned over $100 in interest had you had that money in your account versus the government’s account. The IRS has a withholding calculator here.

You may say that sounds great, I won’t pay any taxes until next year. Don’t do that either. If you under withhold, you can be hit with penalties that would wipe out any extra interest and more.

Recently retired or soon-to-be retired military members should definitely review their withholdings as they start new jobs. See this article on how to avoid the Post-Retirement Tax Shock.

Assess your Increase in Interest Income

With the increase in interest rates, you may be generating more interest income this year. Unless you’ve got a very significant amount in savings vehicles, it probably won’t affect how much you need to withhold. But, it is something to look at and understand that you will need to pay taxes on that income next year at your standard income tax rate.

Capital Gains & Tax Loss Harvesting

Have you sold or do you plan to sell appreciated securities (stocks, bonds, ETFs, or mutual funds) this year in a taxable account? If so, you’ll need to pay taxes on the gains. The good news is for most people those gains are taxed at either the 0 or 15% rate if you held the security for more than a year. The other good news is that if you have some taxable investments that have lost money, you can sell them to offset the gains. If you didn’t take advantage of this in 2022 when both the stock and bond markets were down, you may still be able to if those positions haven’t fully recovered.

Assess Whether or Not to Itemize

Most people no longer itemize deductions because of the increase in the standard deduction. This year it is $13,850 for single filers and $27,700 for married filing jointly. For some people itemizing can still make sense. The primary drivers of the decision could be a large state and/or local tax bill, mortgage interest, high medical bills, or donation(s) to charity. Review where you think you are now to optimize your actions for the rest of the year.

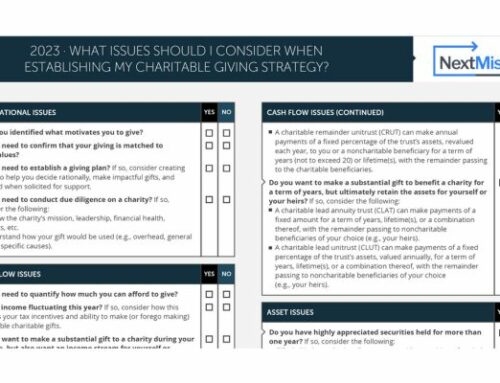

Plan Charitable Donations

If you are planning to itemize, this year could be a great year to clean out the closets, attic, and basement and donate things you no longer need. Just make sure you get a receipt for tax time. For some people bunching donations into one tax year can make sense to allow them to itemize. So instead of making a $5,000 donation each year, you combine them to $10,000 in one year to raise the amount you can deduct. A donor-advised fund can help with this. This article discusses charitable giving strategies in more detail.

Traditional or Roth Contributions

Mid-year is a good time to review whether you’re making Traditional or Roth contributions. If you’re close to the phaseout of certain deductions like the American Opportunity Tax Credit for college or if you’re 63 or older and want to avoid Medicare surcharges, it can make sense to carefully manage your projected Modified Adjustable Gross Income (MAGI). Deferring taxes through a Traditional IRA or 401K can make sense in those situations.

Assess IRA/401K Rollover Options

If your projected income tax bracket is the same or lower than where you think it will be in retirement and you have money in a Traditional IRA or 401K, it might make sense to roll over some or all of that money to a Roth account. You need to have the money to pay the tax bill and it will raise your MAGI so if you’re near threshold limits for deductions or Medicare, make sure you take that into account. There are lots of details and caveats with this so it can make sense to talk to a tax or financial professional on this one.

Tax planning is a year-round sport, and mid-year can be a good time to assess where you are and what actions you should take in the second half of the year.