10 Years From Retirement Check-In

Dreaming of the day you can finally call it quits? If so, do you know if you’re on track? Doing a retirement check-in 10 years before your planned retirement gives you ample time to make adjustments. This could entail saving more or changing your investment strategy to reduce risk. Here are 7 things to do.

Check If You’re On Track

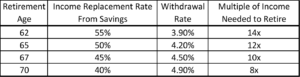

There are numerous free tools and calculators (CalcXML, Flexible Retirement Planner, FireCalc) available that will allow you to get an understanding of where you stand. This table comes from a Fidelity report that looked at retirement saving rules.

Retiring earlier requires you to save a greater multiple of your income because you’ll be needing to use it over a longer period.

Understand Your Social Security Benefits

The Social Security Administration no longer sends out paper statements with your earnings history and estimated benefits. It’s now accessible here. https://www.ssa.gov/onlineservices/ If you’ve never been on the site before you’ll have to create an account to get your information. While this will still change some as you continue to work, it’ll give you a basic idea of what your benefit will be at various ages. While reviewing your benefits, make sure you check your earnings history and correct any mistakes you might find.

Check Your Asset Allocation

As you get closer to retirement, you’ll probably want to de-risk your portfolio. This should be informed by the results of you checking if you’re on track or not. The period of greatest risk for retirement sustainability is the 5 years before and after retirement begins. Significant market downturns during this period can derail good plans that didn’t manage the risk. If you are on track or even ahead of what you might need, consider rebalancing your allocation to take on less risk.

Estimate Your Future Tax Situation

Taxes can be a significant expense even in retirement. There are usually smart things you can do before retirement or early in retirement that can save you money. These include Roth conversions and delaying Social Security. Build a tax projection to allow you to see where and when it might be smart to take advantage of these opportunities.

Build (or Update) Your Estate Plan

It’s important that everyone has an estate plan, but if you’ve delayed doing this is important. Find an estate planning attorney that can create your will and necessary powers of attorney. This is especially important if you have people who rely on you (spouse, children) and as your assets increase. Getting this done will ensure that your assets go to those you want them to. It is also important that you periodically review these documents and any beneficiaries listed on insurance or accounts to verify these are also correct. Finally, make sure several people you trust know where these important documents are.

Think About Medical Insurance and Long-Term Care

If you’ll be 65 or older when you plan to retire, you’ll be eligible for Medicare. If not, medical insurance could be a large expense you’ll want to plan for. For military members, this is one of the great retirement benefits. You’ll have Tricare and won’t need to worry as much about this early retirement expense. Additionally, unless you’re retiring very early thinking about long-term care is important. If you need to put insurance in place, your mid-50s is usually a good time to do that.

Think About What Retirement Will Look Like

Most successful retirees retire TO something versus FROM something. It’s not too early to begin to think about what you’ll do with your time. Golf or that hobby may seem like great options, but will you really do that for 8 hours a day, 5 days a week that you would have been working? For those who are married, it’s also important to have discussions with your spouse about retirement plans. Will you both retire at the same time? Will you relocate? Things will change over the next 10 years, but it’s not too early to begin planning.

Conducting a retirement check-in early is important because you still have time to adjust your plan. That could mean saving more or maybe you determine retirement might become an option in 8 years instead of 10. Either way, having an understanding of where you are allows you to make changes to enable you to get where you want to be.