This is part 3 of our series on the Survivor Benefit Plan (SBP). It provides an SBP Case Study. Links below will take you to parts 1 and 2 with some of the background information.

Series Overview:

Part 1: Basics of SBP (link)

Part 2: SBP (or insurance/annuities) Solving A Cashflow Problem (link)

Part 3: The Decision – SBP or Other Options – An SBP Case Study [This article]

Part 4: Open Season Thoughts (link)

Should You Take SBP? – An SBP Case Study

I covered the basics of the Survivor Benefit Plan and factors that impact a decision regarding SBP in this article (Link to part one). There are a few ways to think about SBP. One of the ways is “Will my spouse get more than I paid in?” or “How long does my spouse have to outlive me?”. Since the premiums and payments are inflation adjusted, it makes the computation relatively easy. Your spouse will need to live 1 month longer than you for every 8.4 months you pay into SBP. If you pay premiums for the 30 years (at which point you are considered fully insured), your spouse will need to outlive you by about 3 and a half years.

I don’t really subscribe to this line of thought. It’s not how I think about insurance. I don’t hope that I eventually have a catastrophic loss from my house to get back the money I paid in homeowner’s insurance premiums, so I don’t think it’s useful with SPB either.

I view SBP as a tool that can potentially be used to provide cash flow in the future. In that way, it is like insurance (calculating your insurance needs article (Link). Unlike insurance, you know what your future cash flow will be in today’s dollars because SBP is inflation adjusted.

What is the need?

SBP provides guaranteed income to your spouse and/or children when you die. The first step is determining if there is a need. There are numerous ways to do this and this article on calculating insurance needs provides some good ways to think about it (link above). I think the best way to do this is to understand the need over time.

Questions to ask

What would happen if you die soon after retirement? How much money is needed? Do you have children at home? Will they need money for education or for daycare and/or after-school care? Is your spouse employed? Will they be able to continue working? How long will spending be at that level? Will it reduce after your children are out of the house?

What would happen if you die near or just after your final retirement begins? What other needs will your spouse have? Will you have paid off any mortgage? What are their other living expenses?

Our SBP Case Study

Jack and Jill are the proto-typical hill-climbing family. Jack, 44, is also a Lt Col (O-5). Jill, 44, is a stay-at-home military spouse, volunteer, and the one who keeps the family on track. They have 2 children, ages 10 and 13. Jack’s looking forward to retiring at the end of 2023 after having served 22 years.

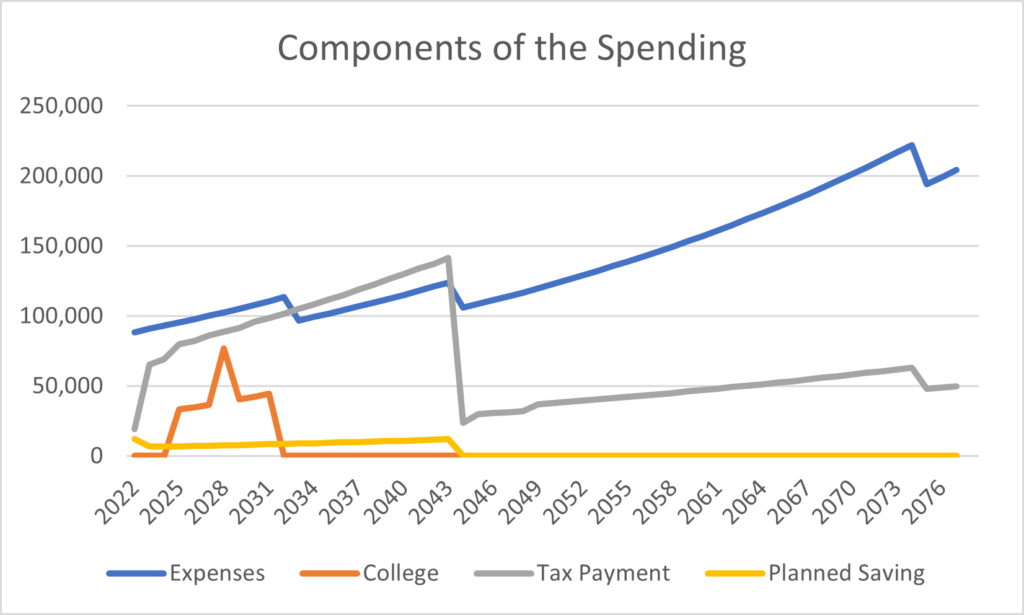

Jack and Jill recently attended TAP and decided they needed to come up with a financial plan and also make a decision about the Survivor Benefit Plan. After looking at their budget they’ve determined their income in 2023 while still active will be $155,000. The basic minimum expenses they need to live on (housing, food, utilities, transportation, etc) is $72000 per year and generally increases with inflation. They know they won’t have to support the kids forever (at least they hope not) and believe they will cost them about $14000 per year through 2033 (again increasing with inflation). They currently invest $24,000 per year. The remaining money pays taxes, and they spend whatever is left on vacations and the nice to haves (estimated at $17,000 for 2023).

Looking ahead to 2024, Jack will get retired pay of $5500 per month based on his high 3 of $10,000 per month and thinks he’ll end up with a VA disability payment of about $15,000 per year. Jill plans to get a job once they are settled and believes she can earn $60,000 per year in a marketing job. Jack plans to begin a second job and expects to make $150,000 per year. They are hoping they can retire at 67.

Jack and Jill’s fixed spending looks like this. Taxes will increase significantly in 2024 because they are both employed and Jack is receiving his pension.

Figure 1. Individual components of Jack and Jill’s spending

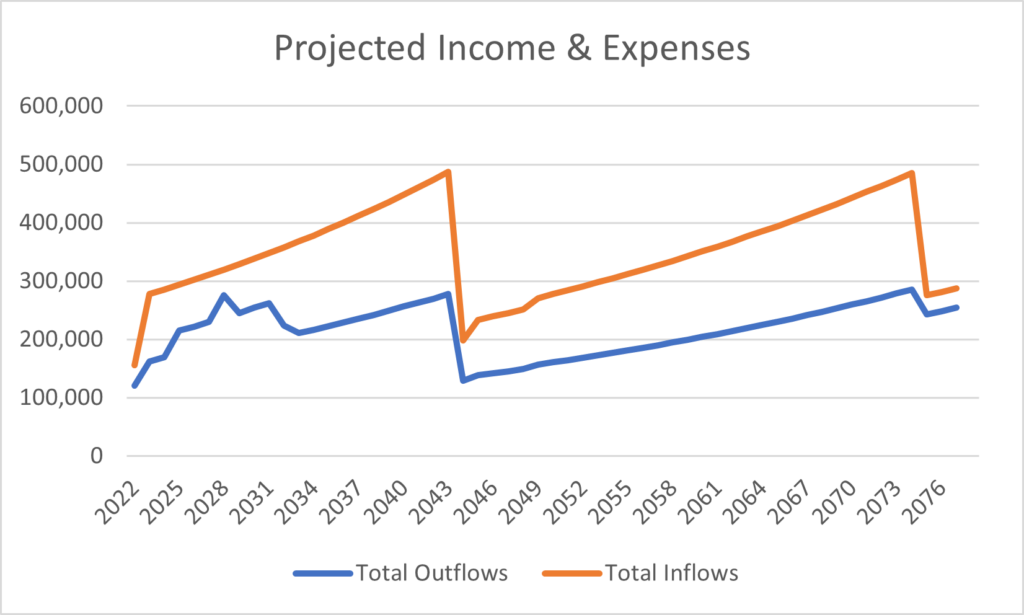

When we combine the yearly expenses and add in their project income it looks like this.

Figure 2. Projected Income and Expenses

They are in excellent shape. The white space between their outflows and inflows is unplanned cash flow meaning they have plenty of margin. These flows are primarily income although $13,000 of annual Required Minimum Distributions start when they are 75 from Jack’s TSP account.

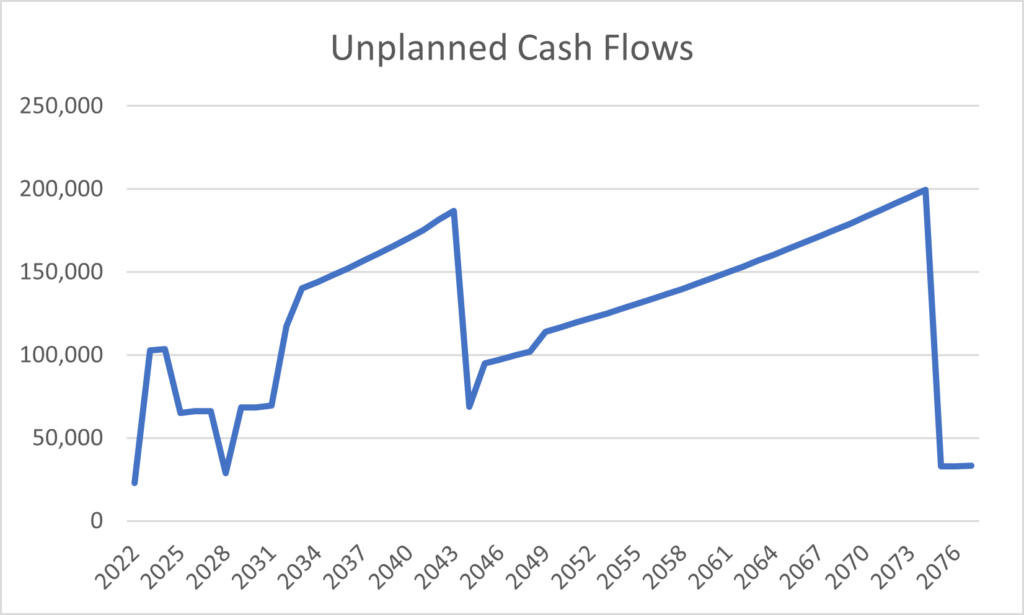

Figure 3. Projected Unplanned Cash Flow

Figure 3 shows the amount of unplanned cash flow by year. They have significant funds to improve their standard of living and increase their investments. They could also explore retiring before 67 if they wanted to.

Life is good and if all went according to plan, they could look forward to a great life. But as I mentioned, Jack and Jill were hill climbers. And at the end of 2025, Jack was hill climbing, slipped on a rock, broke his crown and tragically died. What does Jill’s situation look like now?

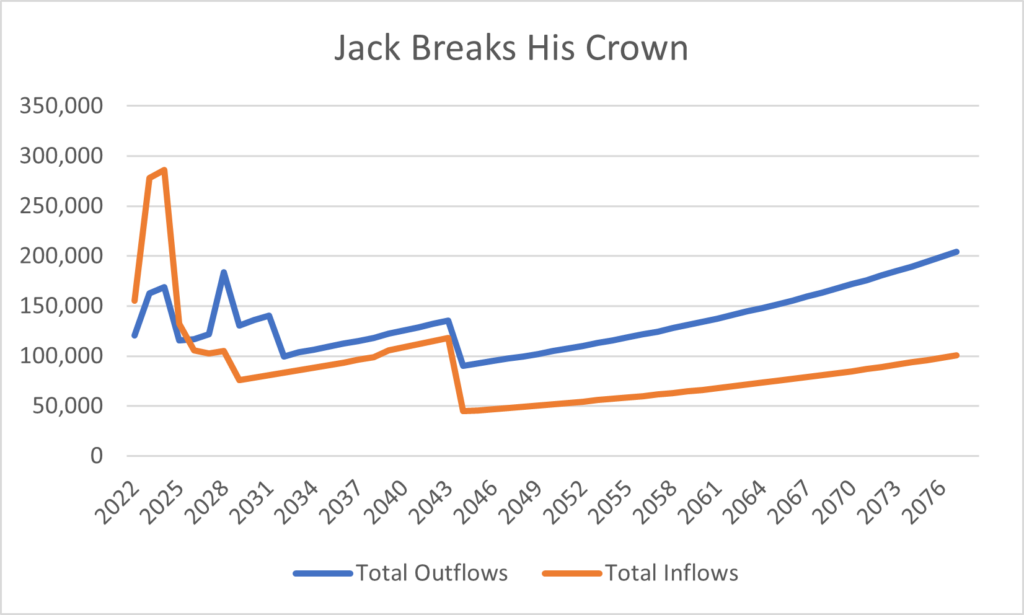

Figure 4. Projected Income and Expenses Should Jack Die at 47

We can see that the picture is no longer so rosy. Jill’s expenses are now greater than her income without Jack’s pension, VA, and second career paycheck. She’ll either need to earn more or lower her standard of living especially in retirement as her only guaranteed income is Social Security.

This is probably the worst-case situation because of the extensive amount of time between Jack and Jill’s death.

SBP To The Rescue?

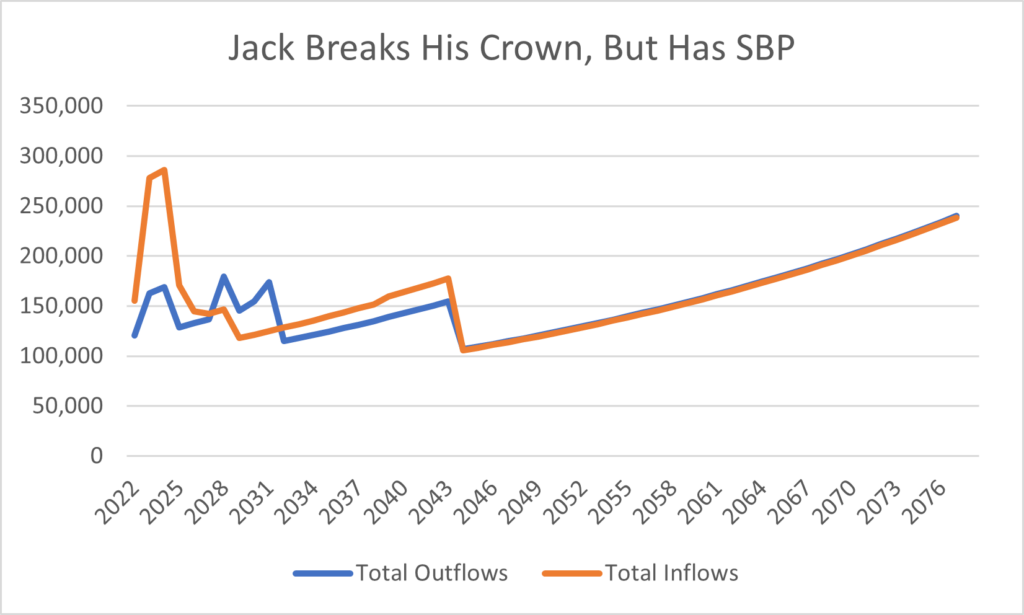

Jack and Jill understand what could happen and elected to take the maximum SBP. This significantly improves Jill’s situation. Expenses during the kid’s college years exceed the income, but this could be solved either through loans or possible additional student aid because of Jill’s drop in income. This analysis is primarily looking at cash flow, but they may also have savings available or could consider a term-life policy on Jack (prior to retirement) to cover the cost of college. A 10-year policy for $100-$200,000 should be sufficient based on the expected gap.

Figure 5. Jack and Jill have SBP

Jack and Jill are happy with this result. They do wonder if there are other options knowing this is a relatively unlikely event. Could savings and insurance accomplish the same thing? What could that look like?

Using Term Insurance

Jack could stack several term life policies that extend out 20 or 25 years that could be used to provide income should he die. For this example, I’m assuming he put in place 3 policies BEFORE retiring.

Policy #1 – 20-year, $1 million policy starting at age 45

Policy #2 – 15-year, $500,000 policy starting at age 45

Policy #3 – 10-year, $500,000 policy starting at age 45

Assuming Jack is in good health he could put this in place for about $210 per month. This would decrease at the 10 and 15-year points as the polices end.

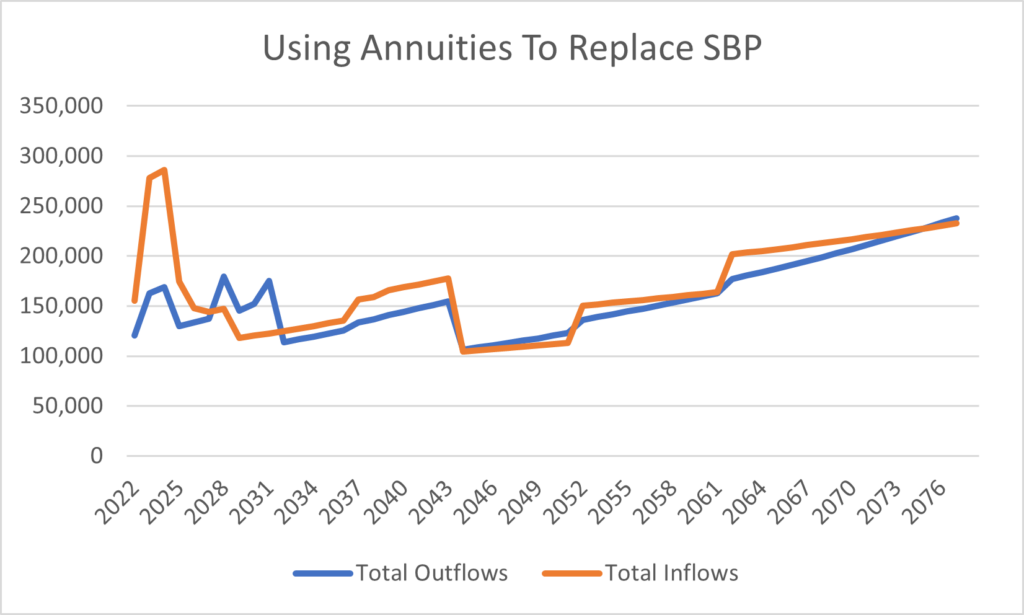

Using about $1 – $1.2 million if Jack dies at 47, they could create an annuity ladder of income that looks like this. This is based on today’s estimated pricing. This is also based on fixed-rate annuities. There are some annuities that will adjust between 1-5% per year that could also be considered, but I am not aware of any that use inflation measures the way SBP does.

The additional funds from insurance proceeds ($800,000 – $1 million) should be invested and used to make up the years where there is a slight shortfall between annuity income and expenses.

Figure 6. Using Annuities Purchased With Insurance Proceeds To Replace SBP

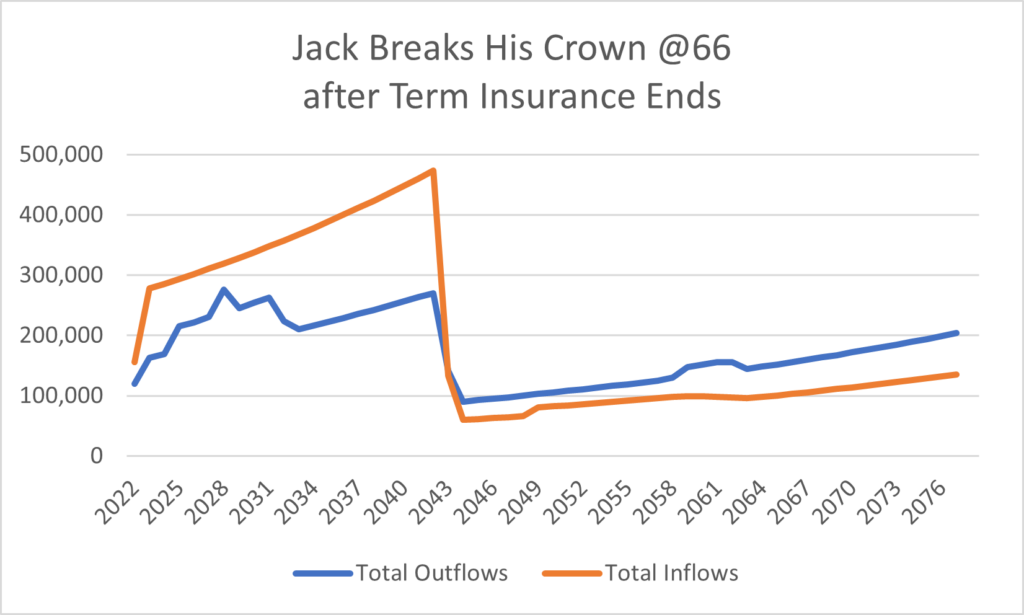

What happens if Jack breaks his crown just after these insurance policies end? Again, we’re left with a delta between Jill’s expenses and her Social Security income.

Figure 7. Projected Income and Expenses if Jack Dies at 66

Jack and Jill would need to save some of their excess income between military retirement and Jack’s unfortunate demise. This excess income is over $2.3 million as modeled. This does not reflect any investment return. Dedicating some of that money to savings would allow for the purchase of an annuity for Jill to provide her income.

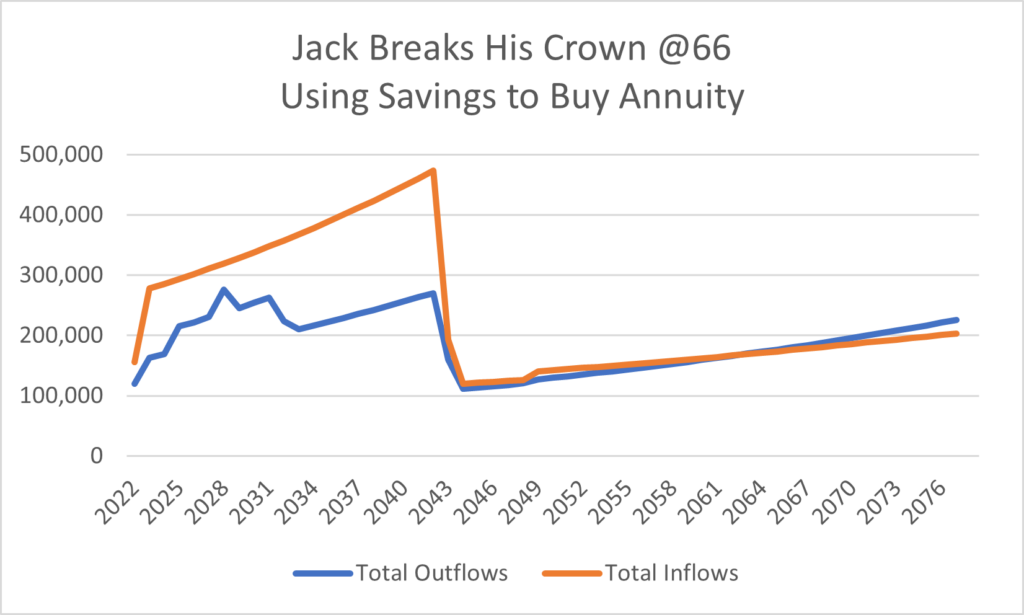

Figure 8. Purchasing an Annuity with Savings If Jack Dies in Retirement

Based on today’s pricing, the additional income starting at age 65 shown in the graph would cost about $800,000. To have a margin of safety, Jack and Jill would probably want to have closer to $1.5 million saved at age 65.

This article is primarily looking at cash flow so the investment profile is beyond this analysis, but it should be considered when you are making your decision.

Which Plan Is Better?

Like many things in life and financial planning, it depends. This really could be a simple decision. If you knew when both you and your spouse would die that would make it much easier. Or even if your spouse will outlive you. Other useful information would be your health, future income levels, investment returns, and inflation. But since we don’t have those, let’s look at some pros and cons of each to help frame the decision.

SBP

+ The SBP guarantee by the federal government is about as solid as it gets

+ The fact that the payout is indexed to inflation is a great feature for spouses who rely on SBP for long-term use

+ SBP premiums are paid with pre-tax dollars reducing taxes each year they are paid

+ One decision and it’s taken care of

– Premiums can be relatively expensive compared to term insurance

– Like other term insurance plans you may not ever use it

– Inflation indexing of premiums means costs may go up on a yearly basis

– SBP and Social Security may not be enough to cover a spouse’s needs after the member dies

– SBP limits who can be a designated beneficiary

Term Insurance or Savings used to purchase an annuity (if needed)

+ Stacking insurance policies could allow you to get cheaper coverage while you need it

+ Flexible options to purchase annuities or invest insurance proceeds

+ Have options to leave an inheritance or guarantee payback with certain annuities

– Inflation can seriously impact payments

– While insurance from highly-rate companies is generally safe; it is not as safe as the government guarantee

– Annuity payouts vary with interest rates

– Investment results aren’t guaranteed

This is a very personal choice each family will need to make. For many (if not most) the best answer is to take some or all of SBP. It is important to consider your options and make an informed decision. While I’ve laid it out in dollars and cents, make sure you don’t discount the sleep-at-night factor and peace of mind that could come from locking in SBP.

If you’re approaching this decision and would like to talk to someone about it, set up a call with me at (Link)

This article is for educational purposes. None of this is tax, legal, or investment advice. Consider consulting a financial professional before making this decision.