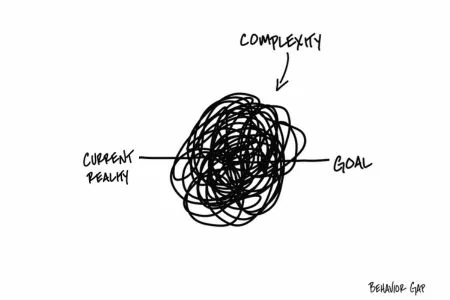

Finances can be

challenging…

Military life and benefits can introduce an

additional level of anxiety and concern.

If you want a trusted partner that

If you want a trusted partner that

1

Helps you align your resources

(time, talent, treasure) with

your goals

2

Simplifies your finances

3

Reduces your anxiety

We can help

What Others Are Saying

Typical Client Questions We Can Help You Answer

Active Duty

Am I saving enough?

How do I maximize the GI Bill for my child’s college?

Can I take off after retirement?

Should I elect to get SBP?

How do I craft a financial transition plan?

Former Military

When can I ultimately retire?

What are strategies to reduce my taxes?

When should I take Social Security?

How can I leave money to my family or charity?

What should I do with my TSP?

Our Services

We work with you to better align your resources and values…balancing living, saving, investing and protecting.

We also understand that flexibility is key as your life can change rapidly, be it deployment, military retirement,

career change or final retirement. We partner to help you achieve your dreams.

We Listen

Our discovery call helps us

understand your values and goals

We Plan

Together we’ll establish a

comprehensive strategy

You Succeed

Our ongoing relationship keeps you

on track as things in life change

Comprehensive

financial advice tailored

to your values.

Mike Hunsberger, is a CERTIFIED FINANCIAL PLANNER® Professional, Military Qualified Financial Planner, Chartered Financial Consultant, and Certified College Financial Consultant.

He founded Next Mission Financial Planning in 2021 after serving 25 years in the Air Force. He wanted to keep serving…choosing to focus on the successful transition of senior military and military personnel to their next mission.

Next Mission Financial Planning provides objective, fiduciary advice always aligned to your best interest.

Your next mission is too important to do

anything else.

Memberships