3 Considerations for Investing a Lump Sum of Money

Investing is typically an ongoing process tied to the steady rhythm of receiving their pay. Occasionally though you may receive a larger lump sum of money from the sale of a house, an inheritance, or maybe a lottery or game show win. This can induce concern about how best to invest it. Here are 3 considerations when deciding how to invest a lump sum.

Time Frame

Time frame, or when you expect to need the money, should be your first consideration. Over the long term, the stock market has been a great investment tool. It can also have significant volatility meaning you could lose money over the short term. This has been the case in the first half of 2022. My general rule is money needed in less than 3-5 years should predominantly be in safer assets like CDs, high-yield savings accounts, I-Bonds, etc.

If this money isn’t needed for many years, investing in the stock market or other longer-term assets that can offer more upside is typically more appropriate. The rest of the article assumes that the money is going to be invested for at least 5 years.

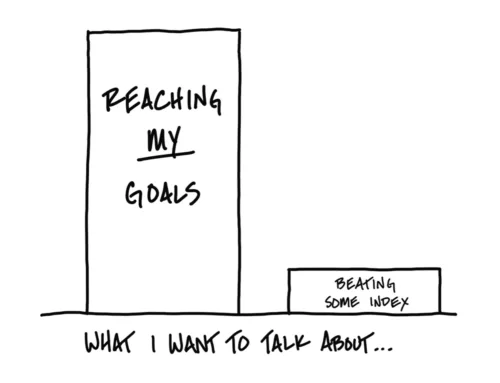

Lump Sum Investing Versus Spreading It Out Over Time – What The Research Shows

The age-old question should I invest my lump sum all at once or spread it out over several months has largely been settled from a purely rational point of view. Because the stock market tends to go up over time, studies show that investing it all at once leads to the best returns. Let’s look at an example. If you had $120,000 to invest on January 1, 2021, and decided to invest in the S&P 500. 6 months later on June 30th, you’d have over $137,000 (14.5% return). You’d be happy you invested it all at the beginning because it basically went up for the next 6 months. That’s great if you’re a purely rational robot. What if you’re a normal person and the stock market doesn’t go straight up for 6 months after you invest?

Your Emotions

People are not purely rational. Dealing with large sums of money can introduce additional issues. You need to try to understand how you’d feel if instead you had $120,000 and invested it all in the S&P 500 on January 1, 2022. Just 6 months later you’d be down to 21% and your $120,000 would be $94,800. It’s never fun when that happens. If that would cause you to consider selling the investment and locking in the losses, spreading out the investment could make more sense for you.

Take Aways

- Understand your time frame first

- Investing the lump sum all at once typically leads to the best results

- Understand your emotions and how you’d feel if you invested the money and it went down significantly in a short amount of time. If this is a concern – consider spreading out your investments of time

How does your mindset affect investing a lump sum? This 1-2 minute, 8-question quiz will provide you with insights. You can take it here.

Don’t have a lump sum to invest, but want to increase your savings. Check out this article.