5 Ways to Optimize Your Saving for the Best Long-Term Results

Saving money is a critical component of long-term wealth. Making savings a continuous habit is a key to that success. These are a few of the tricks that I found to make it easier.

TL;DR Summary

Automate Your Savings

Increase Your Savings Over Time

Know Your Time Frame

Pick The Correct Account Type and Investment or Savings Product

Time Is Your Best Friend

“It’s not how much you make, but how much you keep.” Robert Kiyosaki

Automate Your Savings

“By utilizing strategic onetime decisions and technology, you can create an environment of inevitability—a space where good habits are not just an outcome you hope for, but an outcome that is virtually guaranteed.” James Clear – Atomic Habits

Starting may be hard if you focus on the magnitude of what you need to do. Break it up and take a small step. Just start putting money away. The best way to go about this is to automate the process so you don’t have to make a decision each week or month on what and how much to save or just hoping they’ll be something left over at the end of the month.

If your employer supports it, you could create an automatic payroll deduction to a separate account. If they don’t your bank should allow automated transfers and if they don’t, you should consider finding a new bank. Additionally, there has been an explosion in apps that help you automate savings. These include Digit, Chime, and Acorns. Google automated savings apps or check out this list.

Increase Your Savings Over Time

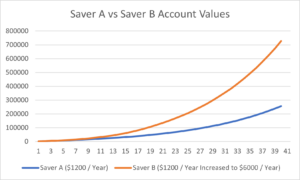

One of my old bosses used to say “start small…scale fast” when talking about projects. I think is a great mantra for savings and investing also. You’ve started and automated your savings. The key now is to grow your savings rate. I find the easiest way to do this is when your income increases before you actually get used to having more money. This could be a promotion, longevity increase, or an annual cost of living adjustment.

For the military using the Thrift Savings Plan or others using their employers 401(K) plan, a good strategy can be to increase the percentage of income being saved each year. In December increase by just one percentage how much you save until you’re at your maximum. Who’s going to really miss one percent of their income especially when the military typically gets a raise in the new year. These little changes add up.

Saver A invests $100 per month while Saver B starts at $100 per month, but gradually increases to $500 per month. On a long time frame, a 7% return results in a significant increase in the money Saver B will have. The Power of Increasing Savings provides all of the details.

Know Your Time Frame

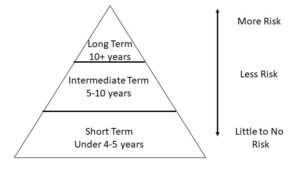

One of the most important aspects of determining where and how to save or invest is the time frame when you will need to use the money. Generally speaking, the shorter your time frame the less risk you want to employ. If you need the money for emergencies or day-to-day spending, you’ll want a super-safe, liquid account like a checking or savings account at a bank. Retirement savings, assuming you’re 10 or more years from retirement, can be in riskier assets or tax-advantaged accounts that require the money to be held until a future date.

Regular monitoring is critical to successful time frame management. What started as a 10-year time horizon will slowly compress and with that should come risk reduction. The pyramid or ladder approach illustrates this concept.

Pick The Correct Account Type and Investment or Savings Product

There are an amazing number of different accounts that can be used to save money for specific purposes in addition to standard bank or credit union checking and savings accounts. Many have tax or other advantages but may come with conditions that must be considered. This could be as simple as a certificate of deposit that requires a minimum holding period to get elevated savings rates. Here are some of the accounts that may be available and useful.

| ACCOUNT TYPE | PURPOSE |

| Checking Account | Daily use – liquidity and cash flow |

| Savings Account | Longer term accrual for emergency funds |

| Bank CD | Money you don’t need for a set amount of time although rates are very low at this time |

| Savings Bonds | Longer term fixed savings – at low rates right now |

| Flexible or Health Savings Account (FSA / HAS) | Tax-advantaged accounts for medical expenses |

| IRA- Individual Retirement Account | Long-term, tax-advantaged way to save for retirement |

| 401K / 403B / TSP | Long-term, tax-advantaged way to save for retirement through an employer |

| 529 | Tax-advantaged college savings |

| UTMA / UGMA | Accounts for minors |

This checklist walks through the various accounts and when you should consider using them to increase your savings.

Time Is Your Best Friend

Warren Buffett, age 91, is worth over $80 Billion. But did you know that 86% or over $70 Billion of that fortune was made after he turned 65. While his returns have been very good, the biggest driver of his success has been the number of years he’s been able to continue compounding his wealth. Uninterrupted compounding is the key to amassing live changing wealth. This is the reason why it is critical to start investing early and do whatever you can to avoid taking out that money unless you absolutely need it.

Happy Saving!