TSP Rollover: 3 and 1/3 Reasons To Consider

You’ve left the military or federal government either for retirement or to take another job. What should you do with your Thrift Savings Plan (TSP) account? Do you leave it or should you consider a TSP rollover? Here are 3 reasons to consider the TSP rollover.

The Thrift Savings Plan or TSP is a great retirement investment program for military and federal employees very similar to a 401K. It has many good aspects…very low investment fees, the ability to take a loan against the balance (if you’re still working for the federal government) and both Traditional and Roth options. But, there are a few reasons you might consider a TSP rollover after you are no longer employed by the federal government or military.

![]()

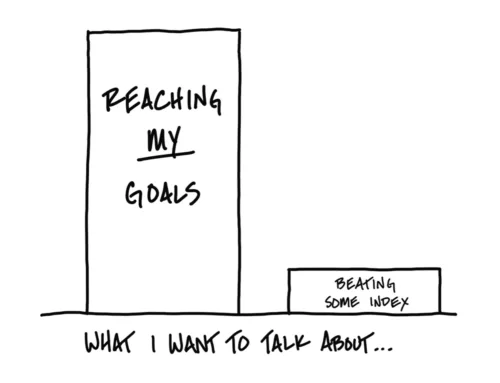

For those of you who are new to my blog, my name is Mike. I am a CFP® professional and flat-fee financial advisor. I’m also a retired Air Force Officer who helping military and military retirees reach their financial goals. I have a newsletter in which I talk about military financial, retirement, and college planning topics which has been described as “Relevant, timely, succinct, and on-point!” Lt Col S.A., USAF (Ret.) – Newsletter reader; not a client.

![]()

1. Consolidation

Simplifying your financial life can make a big difference—especially if you’ve accumulated multiple retirement accounts over the years. Combining your TSP with a new 401(k) or IRA can streamline account management and make it easier to track your investments. This is especially helpful if your TSP balance is modest.

That said, the TSP is known for its extremely low investment fees. Before making a move, compare the costs and features of your new employer’s 401(k) or your chosen IRA custodian to ensure you’re not trading simplicity for higher fees.

2. More Investment Options

While the TSP’s simplicity is a plus for many, its investment options are somewhat limited. Some DIY investors may want more control, while others may prefer professional management.

The TSP does offer a mutual fund window, but it can be costly for smaller accounts (as I’ve discussed in this article). If you’re looking for broader diversification or more active management, rolling over to an IRA could open more possibilities.

3. You Have Non-Spousal Beneficiaries

If you pass away, your spouse can maintain the account within the TSP. However, non-spousal beneficiaries—like your children—have only 90 days to roll the account into an inherited IRA. Miss that window, and the TSP will issue a check, potentially triggering a large tax bill.

Even more importantly, your beneficiaries could lose out on up to 10 years of tax-free growth and flexibility in managing distributions. Most IRA custodians don’t impose such tight deadlines, making a rollover a smart move for estate planning.

3 and 1/3. Converting Traditional TSP to a Roth IRA (This Reason May Expire in 2026)

Most TSP participants have a Traditional TSP account—either because they started before Roth was available, wanted the tax deduction, or received a government match. After leaving federal service, it may make sense—depending on your tax situation—to convert your Traditional TSP to a Roth IRA.

Currently, the TSP doesn’t allow conversions from Traditional to Roth within the plan. Rolling over to an IRA gives you this flexibility.

Note: The Thrift Savings Board has announced that Traditional-to-Roth conversions will be available to all participants starting in 2026—possibly as early as January. So this reason may not be around for long!

TSP Rollovers: A Note of Caution

The TSP, like 401Ks, is tax-deferred and in some cases a tax-free retirement vehicle. There are strict requirements on how this money can be transferred to avoid tax implications. TSP rollovers are no exception. I encourage you to discuss the TSP rollover or Traditional to Roth conversion tax implications with a tax or financial planning professional. This will help you avoid any nasty tax surprises.

If you have any questions on whether a TSP rollover makes sense for you, please schedule a call with me (link) or send us a message via the contact page (link)

Interested in assessing your wealth-building potential? This short, 8 question quiz, can give you insight into wealth building over time based on your indicated saving, spending, and investment habits. Click the link to take the quiz (link).