How To Diversify Your TSP Holdings

After my initial post about the proposed TSP Mutual Fund Window fees (LINK), I received several questions about options to diversify TSP holdings. I also received a question on guidelines on when to consider using the TSP Mutual Fund Window.

Quick recap:

The Federal Retirement Thrift Investment Board, responsible for managing the Thrift Savings Plan issued a proposed rule to establish a Mutual Fund Window in the Federal Register on January 26, 2022 (Proposal). The comment window for the rule extends until March 28, 2022.

Other Options to Diversify Holdings within TSP

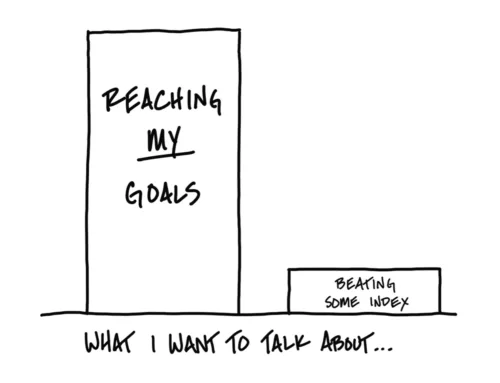

The short answer is there aren’t any other options WITHIN the TSP. Like today, you’ll only have the F, G, C, S, I individual funds or the date-based Lifecycle funds. The TSP is still a great retirement savings vehicle for your core retirement investments. The fees are extremely low and the options are diversified enough to serve as the backbone of your retirement plan. The best way to diversify further is outside your TSP.

Options for current military or government civilians

While not diversification, the first thing you should ensure is that if you are eligible for any matching funds from the government is that you are investing enough to get the full match. I don’t think you’ll find a diversification strategy that is worth passing up matching funds.

If you’ve ensured you’re getting all of your matching funds, the best option for current military or government civilians is to begin or continue contributing to an IRA outside of the TSP. IRAs can be established at many brokerages for minimal fees and depending on the investment, very low trade costs. You are in full control of IRA investments and depending on your tax bracket and filing status an IRA can provide similar tax advantages to the TSP. [Specific rules for IRA tax-advantaged contributions or whether you should contribute to a Traditional or Roth IRA is beyond the scope of this article. Please do your homework or talk to a tax or financial planning professional].

Options for military or government civilians no longer in government service

Former military and government civilians have the option to roll over either all or a portion of their TSP. The TSP can be rolled into a 401K at a new employer or to an IRA which they can control. Major brokerages offer IRA accounts with very low fees for both the account and trading costs (dependent on the investment asset). An IRA at a brokerage could be significantly less expensive than the TSP Mutual Fund Window as currently proposed. This article outlines reasons you should consider rolling over your TSP (LINK).

When could the TSP Mutual Fund Window Make Sense?

The TSP Mutual Fund Window could make sense for members who have accumulated significant assets in their TSP and want additional diversification. My thought is $100,000 was the minimum account balance I’d consider the TSP Mutual Fund Window. Having at least $200,000 would be even better. At $28.75 per trade this only makes sense if you’re going to make transactions of $3,000 or more. These should for individual funds with low fees you intend to hold for several years. The TSP Mutual Fund Window is not for day-trading or chasing the hottest fund each quarter. Trading frequently or picking funds with high fees will quickly negate any diversification advantage you may be gaining over the TSP core funds.

Guidelines for when I’d think about using TSP Mutual Fund Window

- Advanced investors who understand specifically how they want to structure their portfolio

- Move at least $50,000 to the Mutual Fund Window [implies TSP size of $200,000 or more]

- Make individual trades of at least $5,000 and plan to hold for several years

- Only invest in low-fee mutual funds (preferably charging less than .5% per year)

If you liked this article, I send out a newsletter every other Wednesday with things I’ve written or found on the web regarding financial planning for military and veterans. This includes benefits and transition/retirement information. Check out 2 samples and consider joining the scores of other subscribers HERE.