DoD announced that military members will soon have access to a healthcare Flexible Spending Account (FSA). FSAs allow members to elect to have a portion of their pay put into the FSA prior to taxes being taken out. This money can then be used tax-free for qualified healthcare expense like co-pays, over-the-counter medicine, dental, and vision care. This article will provide an overview of the DoD Healthcare FSA benefit, who should consider taking advantage of it, and some things you should watch out for.

What is a Healthcare FSA?

A Healthcare FSA is a valuable legal tax-avoidance tool that allows individuals to set aside pre-tax dollars for eligible healthcare expenses. When you contribute to an FSA, you don’t pay federal, state, Social Security, or Medicare taxes. This also reduces your taxable income, which lowers your overall tax liability.

The funds in an FSA can be used for a wide range of medical expenses which are specified by the IRS. They include copays, deductibles, prescription medications, and even some over-the-counter items. Unlike Health Savings Accounts (HSAs), which are typically paired with high-deductible health plans, FSAs are available to a broader range of individuals and do not require a specific type of health insurance plan. One key feature of FSAs is the “use-it-or-lose-it” rule, which means that any funds not used by the end of the plan year may be forfeited.

The DoD Healthcare FSA

The DoD Healthcare FSA offers a range of benefits specifically tailored for active-duty service members and reservists. The following members are eligible to participate:

- Members of the regular (active) component

- Reserve component members performing Active Guard Reserve (AGR) duty

- National Guard members performing Active Guard Reserve (AGR) duty

- Members of the U.S. Coast Guard Reserve, including Reserve Component Managers, when performing active duty for more than 180 days

The FSA allows participants to contribute between $100 and $3,300 annually. Each Servicemember can open an account so mil-to-mil couples could contribute up to $3,300 in two separate accounts for a total of $6,600. Participants can roll over up to $660 in unused benefit to the following year if they are still enrolled in the program. Enrollment for the DoD Healthcare FSA is managed by FSAFEDS, and there is a special enrollment period in March 2025. Participants will manage this benefit through the FSAFEDS portal.

After the special enrollment period, normal enrollment periods will typically be in mid-November to mid-December for the following calendar year. Eligible expenses must occur between 1 January and 31 December of the plan year to qualify for reimbursement.

Qualified Expenses

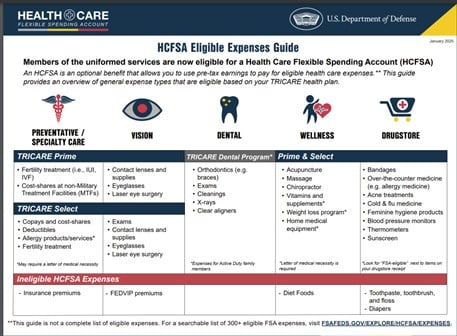

The IRS maintains the specifics on what are qualified expenses, but here is part of a graphic from the DoD Office of Financial Readiness. Link to Full Document

Benefits Of An FSA

Without an FSA, you pay for any out-of-pocket medical expenses with after-tax dollars. The Federal Government, possibly a state government, and Social Security and Medicare benefits have been deducted before you get that money. Let’s look at an example to see the value of the FSA.

Today without an FSA

Let’s say you have a $70 bill for a co-pay. You’ll just pay the $70. If you trace that money back to your paycheck, you’re really paying more than that because you’ve paid taxes on that money. You actually need to earn almost $100 If you’re in the 22% tax bracket to pay that bill. $100-$22 Federal taxes – $7.65 Social Security and Medicare tax = $70.35.

With an FSA

Starting with that same $100, you contribute $70 to your account directly from your paycheck without any taxes being withheld. Once you’ve paid the same $70 bill and submit the receipt, the FSA will reimburse you for the $70. In this simple example, the other $30 will just go to your pay minus taxes. $21 would actually hit your account to spend.

That’s not bad. The estimates are using an FSA will save you about 30% on qualified expenses. If you’re in a higher tax bracket, it’ll be higher. If you have $3,300 in qualified expenses in a year, you could save almost $1000.

Other Considerations

You may be thinking an extra $1000 is great, I’m in. Here are a few things to think about before jumping in.

Review The Qualified Expenses

Make sure you review last year’s qualified expenses and think about healthcare you might need for next year. Single members in the military get most of their healthcare through DoD. You may not have $3300 worth of qualifying expenses and this is use it or lose it (minus $660 you can rollover). You don’t want be the one going to the drug store in late December to buy $150 in Tylenol and cold medicine because you over contributed.

Filing Receipts To Get Reimbursed

Are you someone who tracks expenses and are detailed enough to file to get reimbursements? It is definitely easier if you have several bigger expenses like a $2000 bill for braces than having to save and file forty $25 receipts. The Return on Hassle factor is real. Saving 30% is great, but if you don’t file and end up losing some money by not claiming you’re in a worse situation than if you never signed up.

Retirement and Separation

You’ll want to review how the plan will work in your separation and retirement year to make sure you don’t end up losing money and are still able to fully participate.

Wrap Up

The new Healthcare FSA can be another powerful tool in your financial toolkit if you use it well. Be on the lookout for signup information in March 2025. If you’re reading this after that, consider signing up during the open season typically in November/December of each year.

FINRED Resources

DoD Healthcare FSA Eligible Expenses