Financial Planning Under the Cone of Uncertainty

Hurricane Models

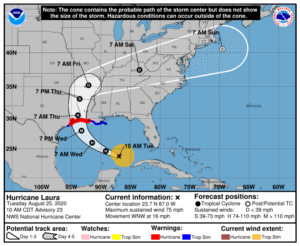

I am fascinated by hurricane tracking models. Strange because I’ve never lived in an area prone to hurricanes. The cone or funnel shape of the forecast shows the probable path of the storm over 5-7 days. The “spaghetti” models are also interesting. These are the individual forecasts that one of the weather supercomputers thinks the storm will take. Sometimes they cluster together. Other times they are wildly different. The forecast improves and the cone narrows as the hurricane progresses and new information is obtained.

Financial Plans

Financial plans should have the same goal. The challenge is greater because you’re dealing with decades not days. Trying to forecast that far out isn’t possible. Think back to where you were 10 years ago. I bet if I asked you then where you’d be and what you’d be doing today you wouldn’t get it completely right. For many, I’d guess you’d say you weren’t even close.

That doesn’t mean you shouldn’t plan or set goals for the future. The plan should be to build flexible goals and targets and like hurricane forecasting be a little more correct each day. If you’re 10+ or even 5+ years from retirement I think that means estimating you’ll retire between 65 and 68 instead of April 4, 2037. This flexibility is commonly referred to as margin of safety. The plan accomplishes this through increased savings to give you that optionality.

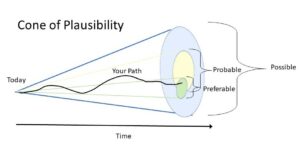

Cone of Plausibility for Future

Goals and situations change significantly as time progresses. The path between today and your future goals will not be straight. Opportunities and challenges that we never imagined emerge all of the time. As the often referenced Eisenhower quote states “Plans are worthless, but planning is everything.” The 75-page financial plan showing you’ll have $2.3 million at retirement on April 4, 2037 and it will last exactly 23.6 years is wrong. But, the exercise of thinking about what the target is today and what it might take to get there is useful. It should be re-visited regularly and adjusted as you go and situations change. That is the real value of financial planning.