Inheriting a Traditional IRA? New Rules May Increase Your Taxes

It’s estimated Gen X and millennials will inherit between $30 and $68 Trillion of wealth as their parents die over the next 25 years. Some of this money will certainly be in the form of Traditional IRAs or 401(K)s. While the SECURE Act, passed in late 2019 introduced new rules for an inherited IRA, the IRS recently released the proposed implementation instructions. The new rules may increase taxes paid on an inherited IRA.

“Stretch IRA” Eliminated

Prior to the SECURE Act, beneficiaries who inherited an IRA or 401(K) [for the rest of the article I’ll refer to just IRA, but it applies to both] could take distributions over their lifetime. This allowed for continued tax-deferred growth in Traditional accounts and tax-free growth in Roth accounts for a longer period of time. It also lowered the annual distributions which for Traditional accounts usually meant smaller tax consequences as they were stretched over many years. The SECURE Act eliminated this option for all but a very few beneficiaries (spouses, minor children until they reach majority, disabled or chronically ill).

New Rules

The SECURE now requires inherited IRAs distribution by December 31, 10 years after the account owner’s death. For example, if the account owner dies in 2022 the beneficiary would need to empty the account by December 31, 2032. Here is where it gets complicated. The SECURE Act specifies that the beneficiary is ALLOWED, BUT NOT REQUIRED to take distributions prior to that date. This means you could allow the accounts to continue to grow tax-deferred or tax-free for 10 years and simply take all the money in the 10th year.

The IRS implementation instructions complicated this. If the decedent had started taking their required minimum distributions (RMDs), the beneficiary must continue taking RMDs under the pre-SECURE Act rules. This would typically be based on the calculated life expectancy of the beneficiary. In addition to RMDs, the beneficiary must also empty the account by the end of the 10th year.

Tax Implications For An Inherited IRA

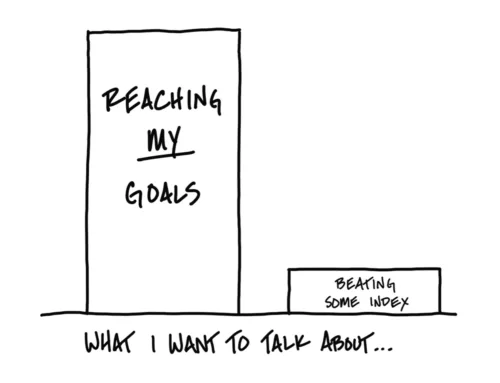

The tax implications for beneficiaries of Traditional accounts could be significant. This is because of the time when most people receive their inheritance. A study by Capital One found that the average age when someone receives an inheritance was 51 in 2016, up from 41 in 1989. It also found that over 25% of inheritances were for beneficiaries over the age of 61. People in their 50s are typically in their highest-earning years. Adding additional RMDs or a full account distribution could make total taxes paid much higher than previous rules. This could also impact people in early retirement who were planning to convert their own Traditional 401(K) or IRAs to Roth accounts. While they may have assumed they’d be in a lower tax bracket during retirement before taking Social Security.

What Can Be Done

Talk About It. While this may be sensitive, it’s important to understand the broad parameters to make a plan. The goal of the account owner is typically to transfer as much of their money to their beneficiaries and not the government. Simply explaining that your interest is paying all required taxes, but not any additional may help you broach the subject.

Make a plan. Once you understand the broad parameters, it’s important to build a plan, especially for large accounts. Timing and future tax changes are the big unknowns. Develop courses of action based on different scenarios. These could include having the account owner take larger distributions from their Traditional accounts if they are in a lower tax bracket than the beneficiary. If not needed, invest the proceeds in a normal brokerage account. These accounts currently receive a step-up in cost basis at the account owner’s death. The account owner could also change the beneficiary to a grandchild likely to be in a lower tax bracket. Additionally, consider charitable contributions which could lower taxes.

Continue to Monitor and Implement When Appropriate. Because of unknown timing and tax law changes, review and update your plan regularly. Certain courses of action may become less advantageous as time progresses. Implement based on the information you have when it’s appropriate.

Summary

The SECURE Act changes to inherited IRAs and 401(K) accounts will have tax implications for their beneficiaries. Understanding this and building a plan can minimize the impact.

This article is provided as general education and not specific tax or investment advice. Consult a tax professional or your financial adviser before making any changes to your plan.