Loss Aversion

This year has been tough for most investors. Stocks are down and so are bonds. This doesn’t happen often, but it does happen. It’s exacerbated by increasing costs of many goods and services. It doesn’t feel very good. If you’ve been investing over the last few years, you probably did pretty well up until late 2021 or early 2022. The problem is most people feel the pain of the recent downturn more than the joy from the increases of prior years. The phenomenon of wanting to avoid this pain can drive us to make additional mistakes. One of these mistakes is loss aversion.

Loss aversion can be summarized by the statement you’ve probably heard before…”I really haven’t lost anything until I sell.” While this is technically true, it may not be the best strategy. We may just be avoiding the inevitable pain. We are biologically wired to feel loss more intensely than we do wins. It’s part of our survival instinct.

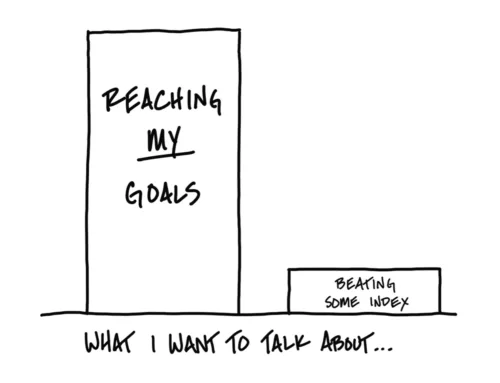

In investing, I will concede that loss aversion is probably more applicable to people investing in individual stocks than in a diversified asset class portfolio. The broadly diversified portfolio’s goal is to achieve some average return as well as balance as some asset classes may be up while others are down.

The Overnight Test

One way to deal with this is through the overnight test. Imagine you had a stock or fund you have been delaying selling after it has lost a bunch of money. You’ve been holding onto it HOPING it will go back up so you can sell. Now imagine tomorrow morning you woke up and instead of the stock or fund in your account, the money is there instead. Would you rebuy that same stock or fund? If not, it may be that you are suffering from some loss aversion.

The overnight test is a great way to give yourself the emotional distance to actually deal with the pain and make a better decision.

If you’re interested in reading more on uncertainty, check out this article on financial planning under conditions of uncertainty (link).