Plan Process Product

Trying to decide on what you’ll invest in before understanding where you are and where you want to go is like trying to decide if you should use a hammer, a wrench, or a screwdriver before you know what you need to fix.

Those things make as much sense as a doctor who writes you a prescription before hearing your symptoms and running some tests. You probably wouldn’t or shouldn’t trust them.

Unfortunately, many in the financial services industry are just trying to make a sale of whatever product they have. That could be a particular investment, insurance, or some other product. They’ve got a way to make it “solve” any problem.

Making smart decisions about your finances starts with a plan. The plan needs to consider where you are and where you want to go. This is the first step.

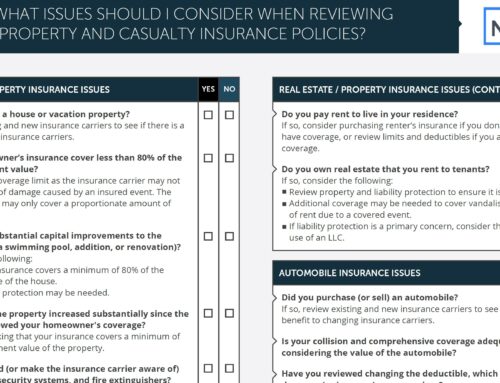

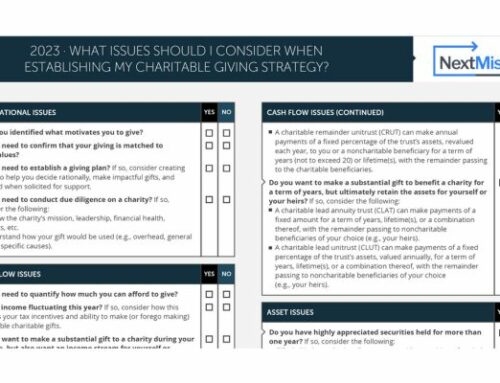

From there you can build out the process of getting from where you are to where you want to go. The overall process breaks down into a savings process, investing process, a process to think about insurance and risk management, retirement, and legacy.

Finally, you figure out how to get there. This is where the specific products, investments, and savings vehicles needed to implement your plan come into play.

Products are important. They just shouldn’t be the first thing you think about.

If you liked this post, check out 6 Critical Financial Plan Elements (Link).