The IRS recently issued final rules based on the SECURE Act. We now have clarity around the 10-year rule for inherited Traditional IRAs and 401Ks. The SECURE Act requires the accounts to be emptied by the beneficiary within 10 years. The final rules now divide whether you can wait until year 10 and take it all or whether you need to take a portion each year based on whether the decedent had started taking Required Minimum Distributions (RMDs).

Basically:

If the Owner dies before they were required to take RMDs, the recipient just has to empty the account any time during the 10-year period.

If the Owner died on/after they were required to take RMDs, the recipient must take distributions years 1-9 and empty the account in year 10. For those who inherited accounts between 2021 the end of 2024, yearly distributions don’t start until 2025, but the 10-year clock is still tied to the date of death.

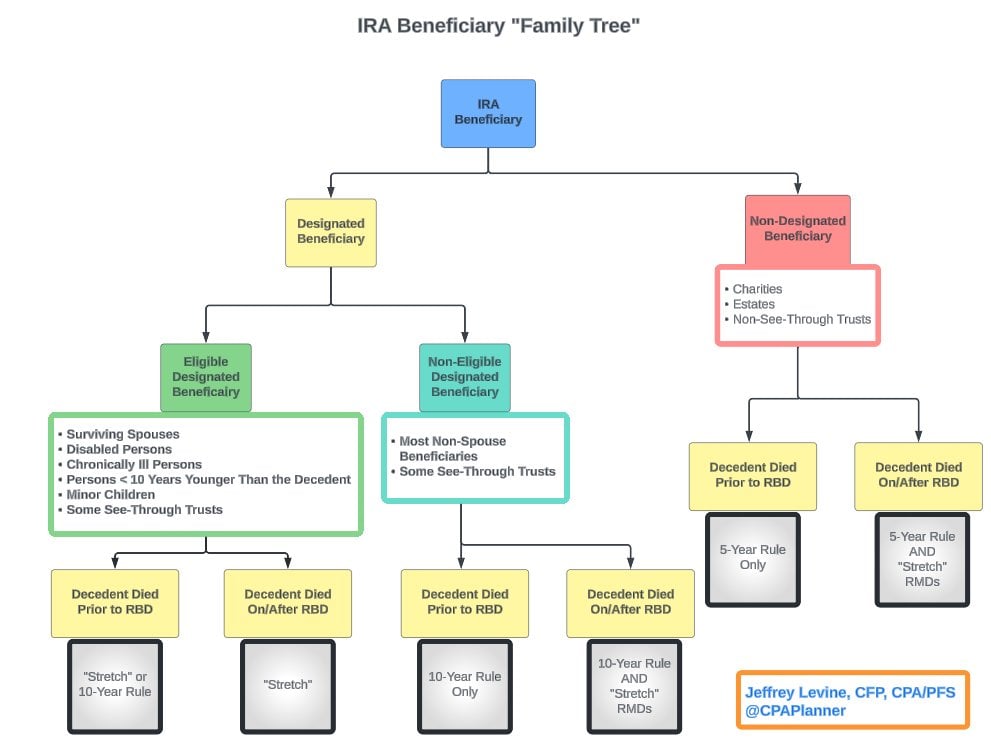

The final rules give some leeway to workplace retirement plans (401K, 403B, TSP) on considerations for RMD beginning dates to allow them to simplify. Additionally, if the decedent’s workplace retirement plan has both Roth and Traditional accounts, new rules would force distributions from both accounts annually over the 10 years. What about inherited Roth IRA accounts? They do not have RMDs so the recipient only needs to empty them by the 10th year. Here is a great graphic that shows the incredibly complicated state of inherited Traditional IRA and 401K accounts. Thanks Jeffrey Levine . If you want more information and even more nuance, check out his great thread on X.com

Bottom line:

This is now incredibly complicated and there are pitfalls that could end up costing you in additional taxes or penalties if you don’t plan this correctly. Talk to a professional to help you navigate it. Also consider talking to family members who may have these accounts on which you might be a beneficiary. There may be significant tax savings by having the current account holder convert their accounts to Roth IRAs if they are in a lower tax bracket than the recipient is/will be.

If you liked this, here’s a link to our previous article on the SECURE Act.