Social Security Case Studies: Claiming for Couples

Planning for retirement involves numerous decisions, and one of the most significant factors is Social Security. Social Security retirement benefits provide inflation-adjusted lifetime payments to recipients and survivors. As I’ve highlighted in the last 2 articles, this decision is complex, especially for married couples. Today we’ll look at 2 Social Security Case Studies and how they might think about maximizing their Social Security benefits.

This is part 3 of our Social Security Series

Part 1: Social Security Basics

Part 2: Social Security for Couples – Spousal and Survivor Benefits

Part 3: Social Security Case Studies – Claiming for Couples

Assumptions for both cases:

The couple has assets (pension and/or significant savings) so they aren’t reliant on Social Security

Health is not a factor in their decision

Case 1: Similar Ages and Similar Earnings History

Jack and Jill are both 60 and looking forward to retiring in 2 years when both are 62. They’ve both consistently worked and their earnings history are similar. Jack’s expected benefit at his full retirement age (FRA) is $2,800. Jill’s expected benefit at her FRA is $3,000.

Analysis

Because they have similar expected benefits, spousal benefits will not be a factor. Since they have other assets, it will make the most sense for Jill to delay to 70 because her benefit is slightly higher. This would allow Jack to receive that benefit if Jill dies first. Jack should consider waiting until at least his FRA and probably even 70. This is especially true if they have a large Traditional IRA/TSP/401K balance they plan to convert to Roth accounts. Delaying will give them additional years for conversions without the additional Social Security income allowing them to convert more at a given marginal tax rate. It will also lower their income and reduce the risk of having additional IRMAA (Medicare) charges.

Case 2: Higher Earner is Older Than Spouse

Jack, 67, just retired and Jill, 61, plans to work 2 more years. Jack has the hiring earnings history. Jack’s benefit at his full retirement age (FRA) is $3,200 and at 70 is ~$3950. Jill’s expected benefit at her FRA is $1,100.

Analysis

Since they don’t need the money, Jack should consider waiting until 70 to claim Social Security. The additional money will increase both his benefit and Jill’s survivor benefit should Jack die first. She would continue to get Jack’s current benefit (~$3950 assuming he waited until 70). Based on the age difference and the fact women typically live longer that men there is a good possibly that she get the survivor benefit at some point.

The decision on when Jill should claim is more complex. She will be eligible for a spousal benefits when she claims because her benefit is under 50% of Jack’s. So let’s look at some possible strategies. To maximize the spousal benefit, she would need to wait until her FRA to claim. If she did, she’d get $1,600 because spousal benefits are based on FRA and do not get to take advantage of delayed credits. She has no incentive to delay beyond FRA because even with delayed credits here maximum personal benefit would be ~$1350 (less than the $1,600 spousal benefit).

Jill could claim as early as 62, but if she plans to continue working for another year, she would probably get very little benefit from doing that because of earnings limits and taxes. So let’s look at what happens if Jill claims at 63. Remember spousal benefits are made up of two parts: Jill’s own benefit + the spousal top-off. In Jill’s case the top-off is $500 (50% of Jack’s FRA benefit – Jill’s FRA benefit – $1600-$1100) on Jack claims. If Jill claims at 63, it would reduce her benefit to ~$825 so her maximum spousal benefit would be ~$1325. Assuming Jack waits until 70, Jill wouldn’t get the spousal top up until age 64.

Claiming early between 63 and 67 could make sense for Jill since she’s guaranteed the higher survivor benefit if Jack dies first. Both of their health and longevity expectations should be factored in.

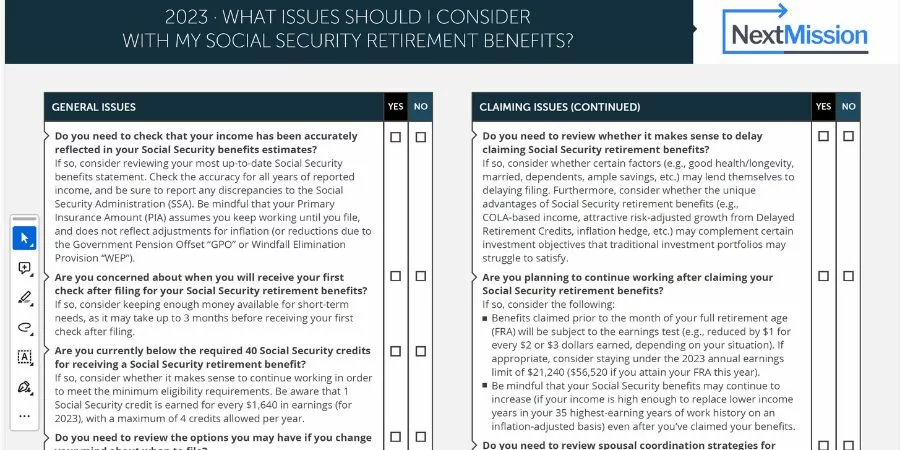

While these cases can give you thoughts on how and when you might think about claiming Social Security, every couples situation is different. Other income, taxes, investments, and IRA/401K conversion opportunities all need to be integrated. If you’re a do-it-yourselfer, there are calculators out there that can help you make the decision. If you’re approaching Social Security claiming or have another financial decision, you’d like to discuss you can set up a call with me here (link). You can also download this handy Social Security Checklist.

Click the image for a 2-page Social Security Checklist which covers:

- General Information

- Claiming

- Taxes

- Other considerations