Tax Strategy & Tactics: Build and Execute Your Plan

Did you pay enough in taxes this year? You may be saying Mike, that is a dumb question. I paid TOO much in taxes. But are you sure? Could you have paid more in taxes this year that would save you much more later? Do you have a multi-year tax strategy? Are you working to minimize your taxes not just this year, but over your lifetime? Or, if you’re planning to gift to your children are you optimizing taxes of your and their lifetimes?

[Quick Caveat: This is educational information only and not tax or investment advice]The Federal tax bill for O-5s and above can easily be $10,000 even if their spouse doesn’t have any income. For single members, it can be even higher. After military retirement, when you have a pension and a second income, you might be paying more than $35,000 per year in Federal taxes. How confident are you that you’ve optimized your tax strategy?

I like to say the goal with taxes should be to pay every cent we owe, but not leave the government a tip. Smart tax decisions can have a 6-figure impact over your lifetime versus just trying to optimize for the current year. So how do I figure out what to do?

A note of caution: CPAs like to say the tax code is written in pencil. That’s because Congress can change it at any time. This has been especially true recently with numerous significant tax changes just since the Tax Cuts and Jobs Act in 2017 (link). Tax planning requires you to plan based on what you know and update it when the law changes.

Tax Strategy

The overall context of tax strategy centers on when you should defer taxes versus when should you pay or even accelerate taxes.

Step 1: Create a notional income map by age

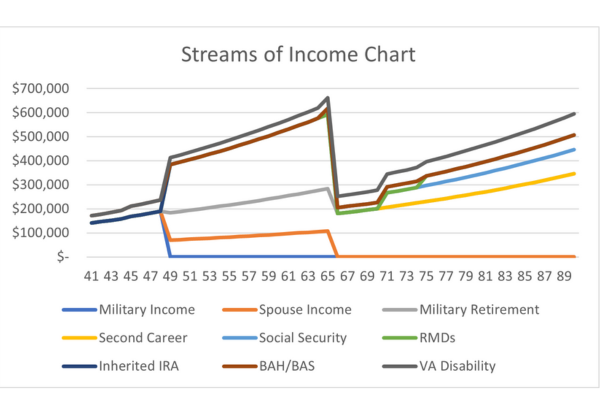

This graphic is based on a simple Excel spreadsheet that I used to map the stream of income a senior military member could expect over their life. It shows both tax and untaxed streams. The numbers are important, but the general slope of the total income is.

You can see there is military income, BAH/BAS benefits, retirement pay, post-retirement employment, an inherited IRA, VA disability, etc. stacked based on the time they apply.

This chart assumes an overall inflation rate of 2.75%.

Step 2: Align your income map with tax rates

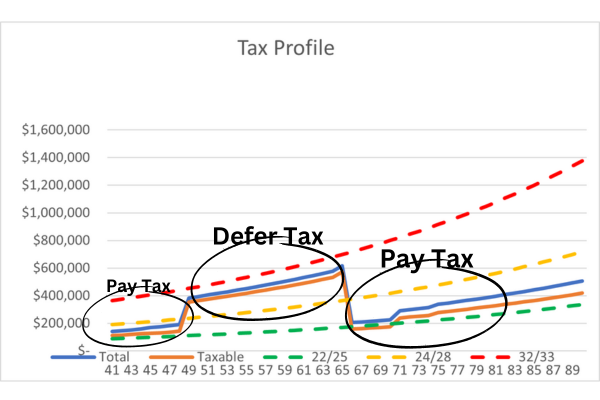

This simplified version shows taxable income (orange line) and total income (taxable + non-taxable) income (blue line). The dashed lines are the current tax brackets (adjusted for inflation). [Note: The current tax rates from the Tax Cuts and Jobs Act are supposed to sunset in 2026. This means the current 22% bracket goes back to 25%, the 24% goes back to 28% and the 32% goes back to 33%.]

Step 3: Estimate your average tax level

You can see that both while on active duty and in ultimate retirement the income and tax rate will be lower than in the period of a post-military second career. You can see that if you took the overall income and smoothed it out, this couple would trend to the upper end of the 22/25% tax bracket. The important piece is it looks like they’ll have some room early in retirement to convert any tax-deferred savings at the 15% bracket and definitely at the 22/25% brackets.

Once understand where you might be over time, you can take action to defer taxes when your above your average tax rate and pay or even accelerate taxes when you’re below.

The Tactics

You may be thinking OK that makes sense, but I can’t just tell the IRS I’d like to adjust what I’m paying until I’m in a lower bracket. That’s true, but there are some things you can do.

No matter what tax bracket you’re in:

Health Savings Account (HSA) – HSAs have a very rare, triple-tax benefit. You get a tax deduction for the contribution, they grow tax-free, and as long as you use it for qualified medical expenses, it gets withdrawn tax-free. The negative: You have to have qualified high-deductible health insurance. Tricare coverage negates your ability to contribute to an HSA.

Asset location – People like to talk about asset allocation, meaning how much you’ve invested in stocks, bonds, and which types: small cap, large cap, growth, value, international. Asset location means which account you put specific types of investments in for tax advantage. If you hold bonds or dividend-paying stocks in a taxable account, you’ll pay tax every year on the interest. If they are in an IRA or 401K, you’ll get tax-deferred growth. Holding growth stocks that don’t pay dividends in a taxable account allows you to defer taxes until you sell them. Additionally, when you die, these get a step up in basis to their current value meaning all of that growth is tax-free.

Tax Loss Harvesting – Selling an asset in a taxable account that has lost value and is lower than when you bought it allows you to offset the loss against other capital gains. If you don’t have offsetting gains, you can deduct up to $3,000 per year from income. If the loss is bigger than that, you can carry it forward to offset future capital gains.

You’ll want to avoid the wash-sale rule (link) which says you can’t sell an asset for a loss and then immediately buy it back. Check out the link or talk to a tax or financial professional.

When you’re in a lower tax bracket

Roth IRAs, 401Ks, or TSP – Contributions made to Roth accounts are done with after-tax dollars but grow and are withdrawn tax-free. Your heirs will inherit Roth accounts tax-free when you die.

529 Plans for Education Savings – Contributions are also made with after-tax dollars but grow and can be withdrawn for qualified education costs tax-free. These can make sense at any tax bracket, but if you’re going to be in a higher tax bracket when the beneficiary is in college it can be particularly impactful versus saving in a non-tax advantaged account or paying from cash flow.

Savings bonds (specifically for education) – Government savings bonds are purchased with after-tax dollars but are not subject to state or local taxes. Additionally, if they are used for qualified education expenses the interest is exempt from federal income tax.

Long-Term Capital Gains – Capital gains occur when you sell an asset (think stock, mutual fund, ETF) for more than you paid for it. The long-term tax rate applies when you hold a security for more than 1 year. For 2023, a married couple with a taxable income of up to $89,250 will pay 0% on long-term capital gains. If you’re in this situation it can make sense to sell appreciated assets you’ve held for more than a year and then buy them back to reset your cost basis. [Note: You may be thinking about the wash-sale, but that is only for losses not gains]

Traditional to Roth IRA/401K Conversions – If you’re in a lower tax bracket and have additional room before you bump into the next tax bracket it can make sense to convert traditional IRAs, 401Ks, or TSP to Roth accounts. You’ll pay the tax when you convert, but you’ll get tax-free growth and withdrawals in the future. [Note: Some 401Ks may allow you to do this while you’re still working for the company. For TSP you can only conduct rollovers after you’ve ended your government or military service]

When You’re In A Higher Tax Bracket

Traditional 401K, or TSP – Contributions to traditional accounts are made with pre-tax dollars. The accounts grow tax-free, but withdrawals are taxed at your current income rate.

Traditional IRA – You may be able to contribute pre-tax dollars to a Traditional IRA (reducing your current year’s tax bill). There are numerous different limits on this based on workplace retirement plan coverage, etc. That’s beyond the scope of this article, but make sure you do your homework.

Backdoor/Mega Backdoor Roth – While there are limits on how much you can deduct every year using tax deferment, you may have the option of moving after-tax contributions from an IRA or 401(K) to Roth accounts. This would have all the benefits of Roth accounts – tax-free growth and withdrawals. [Again – there are many nuances with these strategies so make sure understand them or consult with a professional who can help you.]

Flexible Spending Accounts (FSAs) for Healthcare – Workplace FSAs allow you to contribute pre-tax dollars to be used for healthcare costs. In higher tax brackets this can be a significant saving. The drawback is that you have to use the money you’ve contributed by the end of each year. You don’t want to over contribute or you may lose the money or waste it on things you really didn’t need.

Municipal Bonds – Municipal bonds are exempt from Federal taxes. Municipal bonds may also be exempt from state and local taxes if they are issued from within your state. Because of the tax advantage, they typically pay a lower rate than other bonds. Use a calculator to compare and make sure it’s really the best deal for your situation.

Wrap Up

Taxes are complex. They are also one of, if not the biggest expense you’ll have in any given year. These two facts make a multi-year tax strategy a critical piece of any financial plan. Smart decisions can make a huge difference in how much you’ll pay over your lifetime.

If you liked this post, check out Are You Building A Retirement Tax Bomb? (Link)