TSP Mutual Fund Window – Too Expensive For Small Accounts

The Thrift Savings Plan (TSP) could soon be getting a major investment choice overhaul through the TSP Mutual Fund Window. Under a new proposal, military and federal employees could have access to 5,000 mutual funds. This is a huge increase from the 5 current index funds and the Lifecycle funds which are blends of the 5 primary funds. So is this a good deal for TSP participants? Let’s look at what we know so far.

![]()

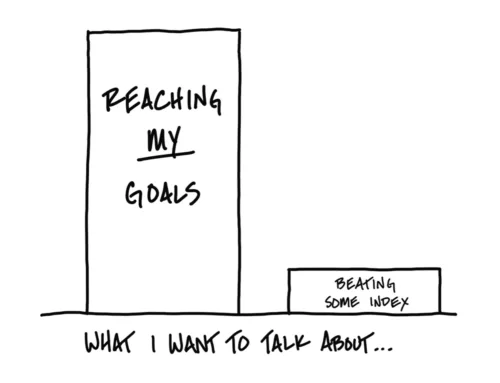

For those of you who are new to my blog, my name is Mike. I am a CFP® professional and flat-fee financial advisor. I’m also a retired Air Force Officer who helping military and military retirees reach their financial goals. I have a newsletter in which I talk about military financial, retirement, and college planning topics which has been described as “Relevant, timely, succinct, and on-point!” Lt Col S.A., USAF (Ret.) – Newsletter reader; not a client.

![]()

The TSP Mutual Fund Window Proposal

The Federal Retirement Thrift Investment Board, responsible for managing the Thrift Savings Plan issued a proposed rule to establish a Mutual Fund Window in the Federal Register on January 26, 2022 (Proposal). The comment window for the rule extends until March 28, 2022. The minimum initial transfer is $10,000 and cannot exceed 25% of your overall TSP balance meaning you must have at least $40,000 in your TSP account to participate.

The Fees

$95 – annual maintenance fee

$28.75 – per trade fee

Fees assessed by individual mutual funds (typically on the order of 0.5 – 1%, but could be higher)

$55 – annual TSP fee (based on net revenue the TSP will lose); will be assessed/adjusted every 3 years

TSP Mutual Fund Window Transfer Limits

Under the proposal, participants are still limited to 2 interfund transfers per month. Each fund transfer to or from the mutual fund window will count as a transfer under this limit. There didn’t appear to be a trade limit once the money was transferred to the mutual fund window.

TSP Mutual Fund Window Costs Versus TSP Core

The TSP, with its limited choices, is known for its low fees (TSP expenses). Let’s look at what it would cost a participant who has the minimum account size, $40,000, and wants to use the Mutual Fund Window. Today, the most they are paying in fees to the TSP would be $40,000 time 0.059% (assuming they are 100% in the Small Cap S Fund). This is $23.60 per year.

Moving $10,000 to Mutual Fund Window to invest in 2 different funds

| Annual Maintenance Fee | $95.00 |

| Trade Fee – Assuming only 2 funds | $57.50 |

| Estimated Mutual Fund Fee (low-end estimate of 0.5%) | $50.00 |

| Annual TSP Fee | $55.00 |

| Total | $251.00 |

That’s roughly 2.5% of their $10,000. This is also a conservative number. If the participant decides to split it into additional funds, chooses higher-cost funds, or trade in and out of mutual funds these costs will be considerably higher. Additionally, they will still have the $18.70 fee for the $30,000.

I don’t think this is a good deal for those with the minimum account size TSP is going to allow to participate.

When Might It Become A Good Deal?

The diversification provided additional mutual fund options could start to make sense with a larger account. My goal is to always keep investing expenses below 1% (preferably even lower). Depending on the underlying mutual fund expenses, I think it would require a TSP balance of about $300,000 (allowing participants to move 75,000) to get into the 1% target range. It would also require minimal trading between mutual funds and trades of at least $3,000.

Other TSP Options

Here’s how you could consider diversifying even if you have a small account (Link)

If you’re no longer in the military or federal service, a TSP rollover could make sense. Check out this article with 3 Reasons to Consider A TSP Rollover (Link)

If you liked this article, I send out a newsletter every other Wednesday with things I’ve written or found on the web regarding financial planning for military and veterans. This includes benefits and transition/retirement information. Check out 2 samples and consider joining over 300 other subscribers HERE.