I feel like I’m starting late. Am I Behind?

I’ve talked with several people recently who have all expressed the concern that they were approaching military retirement and felt like they were behind where they should be with preparing for retirement. I will say I’m a HUGE proponent of starting early because the time component of compound returns is magical. I also think military retirees aren’t as behind as they might think.

Value of the Military Pension

There are numerous ways to try to value a military pension. This article on The Military Wallet (link) does a good job of walking through the mechanics. An E-7’s, who retires at 20 years, pension is conservatively worth over $1 million. An O-5s is probably worth at least $2 million. If you’re also receiving additional VA disability, you’d also want to factor that in.

How Does That Compare?

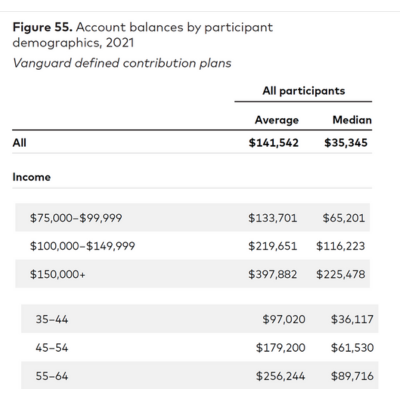

Vanguard (one of the largest 401K companies) produces a report called How America Saves that looks at retirement accounts they manage. It has some great data to get a sense of compared to non-military savings tendencies.

Breakdown by Income & Age

The report has a table that breaks down account balances across several demographic categories. The most interesting to me are income and age. Based on income, the value of a military pension is significantly above even the top category of people earning > $150,000 on both an average and median basis. [Median is just the value of the 50th percentile of accounts so it’s not skewed by the giant 401Ks]

Additionally, on an age basis, the military pension is a much higher value than the average and median values.

A few caveats:

People may have multiple 401Ks not all custodied at Fidelity

People may also have IRAs they are using to save for retirement

Another recent report by Natixis (link)highlighted what different generations thought they’d need and then looked at where they are.

“Generation X workers (ages 43–57) have a funding target of $1.2 million – which is the highest among all three generations. But median savings of $81,000 is not likely to get them over the line – not unless they generate average savings of $59,000 every year until age 65, when they plan to retire.”

Recommended Savings:

Another way to look at this is recommended savings rates. This time we’ll use a Fidelity Report – How Much Do I Need To Retire (link). Here’s the relevant info:

- By age 40, you should have three times your annual salary already saved.

- By age 50, you should have six times your salary across your accounts.

Here again, we see the military pension stacks up very well against Fidelity’s suggested savings. The caveat with this is that technically the “value” of the military pension decreases over time because as you age you have fewer years that you’ll receive it.

Negatives

The biggest drawback of a stream of income tied to someone’s life is that once they die, the income ends. Your military pension is no different. I know the Survivor Benefit Plan (SBP) can extend that, but even with the SBP, there is nothing that can be passed to heirs when you die.

What To Do Now

Most folks aren’t able to fully live on their military pension in retirement at least until they can claim Social Security. Because you’ll probably get that second job, you have the opportunity to start or increase the amount you are saving and investing. The key here is to do this BEFORE you get used to living on the increase.

How much to save is dependent on numerous factors. I’d start by comparing your total after-tax income you had on active duty, factoring in the tax advantages, to your total after-tax money you’ll have with your pension, plus any VA benefits, and second career income. The difference is the “new money” that you now have but haven’t gotten used to living on.

You can spend that new money, save it, or give it away. Saving a large portion of this money could allow you to fully retire earlier or fund an inheritance or charitable donation. Additionally, the less you use to increase your lifestyle the less you’ll have to replace with income from savings or investments in ultimate retirement.

P.S. We love helping clients set and work toward their “Freedom By Date” whether they’re starting late or are well on their way. We believe Financial Freedom = Options. For some this means ultimate retirement and for others, it’s starting a new project or business. If you’d like to talk about your “Freedom By Date” or your specific situation, you can schedule some time on my calendar.

If you liked this article, check out this one on Conducting A Retirement Checkup 10 Years Prior to Retirement (Link)