Discretionary Dollars

In a previous article (LINK), I introduced the concept of Minimum Lifestyle Expenses (MLE). MLE is composed of your Food, Utilities, Transportation, Housing, and Healthcare. Income above this level is discretionary. There are 3 things you can do with this income. You can spend it, save it, or give it away. [Some people will add a 4th which is owe it, but I consider that spending pulled forward.]

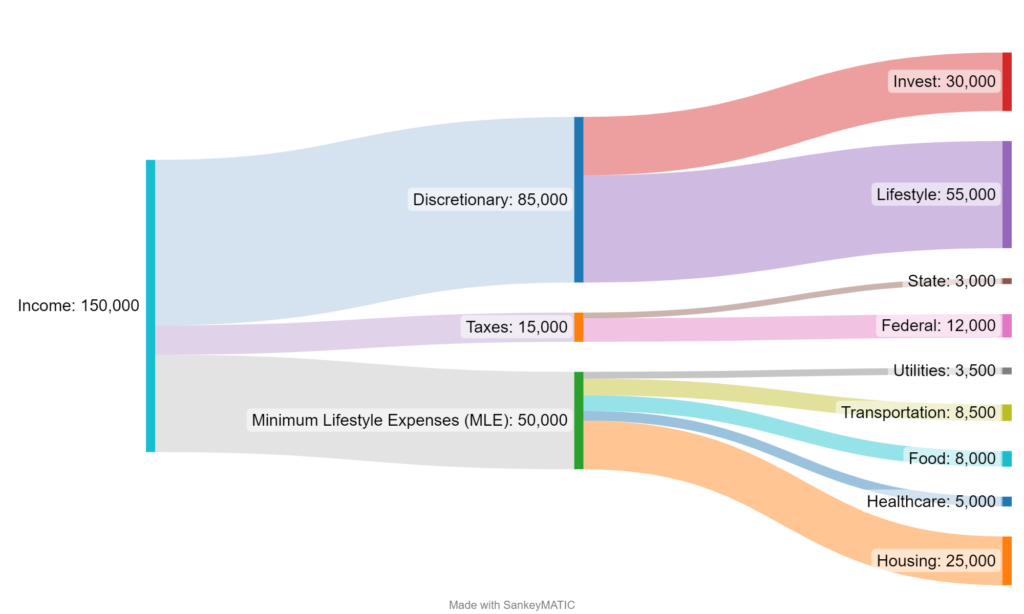

Pre-Retirement and Discretionary Dollars

We’ll continue with our example. Assuming their discretionary income is $85,000 they could increase their standard of living (nicer vehicles, travel, upgraded home furnishings, or whatever their priorities are). They could also give to charity, kids, or other family members/friends. Finally, they could invest it for the future. That could be for retirement or a large upcoming purchase like kid’s education or house/vacation house.

Assuming they’ll want to maintain a similar lifestyle in retirement, the more they save means the less they’ll need to replace when they are no longer working. In this example, their net spend each year is $120,000 ($150,000 of income – $30,000 of savings). This is what they’d need to replace in retirement. If they were saving $40,000 per year, they’d only need to replace $110,000 per year allowing their savings to last longer.

Retirement and Discretionary Dollars

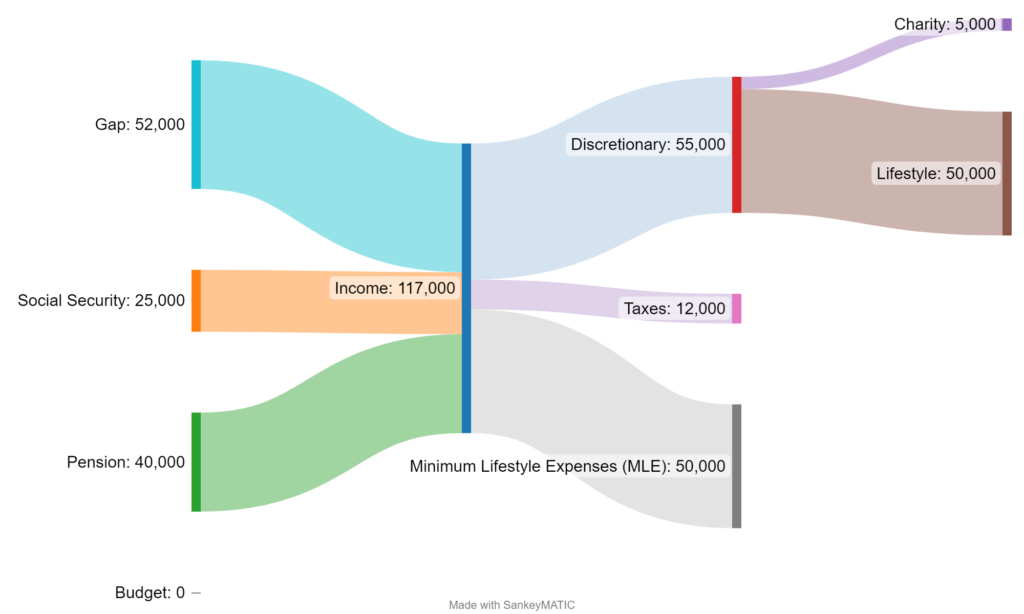

So how does this work in retirement when there isn’t income from a job? Assuming they want to maintain a similar lifestyle, we can see that they’ll now need about $117,000 (the additional $3,000 is from a theoretical reduction of taxes). The savings portion of discretionary is gone because they are now living off their savings.

We’ll assume the retiree has a pension. If not, they should consider some other form of guaranteed income to meet their minimum lifestyle expenses. In this case, their pension and social security cover their MLE. This is great.

But, their guaranteed income is only $65,000 leaving a $52,000 gap they’ll need to make up from their savings and investments. The general rule of thumb is that for a planned retirement of 30 years, is to multiply whatever income you need by 25. This will get you into the ballpark of how much money you need. In this case, that is about $1.3 million (in today’s dollars).

Again, this is the ballpark. They could need more if they wanted to leave a specific inheritance amount, have big travel plans early in retirement, or want to buy a second home. They could also need less if they plan a moderate retirement or relocate to a more affordable area. As they get closer to retirement, they’d have a much more detailed plan earmarking money for their travel, inheritance, long-term care, etc.

The decumulation phase of retirement can make the accumulation phase look easy. Unless your retirement is significantly overfunded, the fear of running out of money is always in most people’s minds. This leads to a reduced risk tolerance, especially in what I like to call the retirement red zone. This is the period of about 5 years on either side of retirement when an investment loss can severely damage retirement plans. Guaranteed income, understanding goals and desires, and proper positioning of your discretionary money are typically what determine how much you need to worry and how much you can just enjoy your golden years.