Start Them Early – Roth IRA For Kids

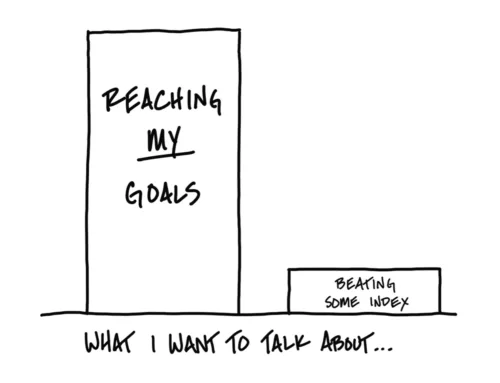

“Compound interest is the 8th wonder of the world”. While there is little evidence that Einstein actually said this, compound interest is amazing. But to really see the outsized effects, you need time. A significant amount of time. Who still has lots of time to allow their investments to grow? Your kids do.

Now, you may be thinking it’s a little early to be thinking about retirement for my teenager. It’s really not. The tax advantages and flexibility of the Roth IRA for kids also make it a great option even if they may need some of the money before retirement.

Did your child work this summer or maybe throughout the school year? They are probably eligible to start a Roth. It provides a great opportunity for them to allow compounding free of taxes to work for many years.

Starting Early

Starting early and allowing compound interest to work is a key to building long-term wealth. Let’s assume that over their teenage years, your child is able to save money into their Roth IRA, and on their 20th birthday the account has $10,000 in it.

That $10,000 will be worth $239,000 when they turn 65. At 70 it’ll be worth over $420,000. Both assume a 7.5% rate of return. If you factor in 2.5% inflation, it’d still be over $94,000 and $121,000 in today’s dollars, respectively.

Roth IRA Basics

A Roth IRA is a retirement account that is funded with after-tax money that grows and can be withdrawn in the future with no additional taxes. In contrast, a Traditional IRA allows you to defer taxes initially and allows the money to grow tax-free, but when you ultimately withdraw the money you will pay taxes.

Contribution and Income Limits

For 2023, your child can put the lesser of the $6,500 limit ($7,500 if you’re 50 or older) or 100% of their income into an IRA. Roth IRAs also have an income limit. They can contribute if their 2023 modified adjusted gross income is under $153,000. Most kids probably aren’t coming anywhere close to that limit.

Quick example – If your child worked throughout the year, and earned $3,000, that’s the maximum they could contribute to their IRA. If instead, they earned $8,000, they could contribute up to $6,500.

Earned Income Requirement

Earned income includes wages, salary, commissions, tips, bonuses, self-employment income, taxable non-tuition, stipend payments, and nontaxable combat pay.

Various types of income are not considered earned income for the purposes of contributing to a Roth IRA. These include earnings and profits from property, interest and dividend income, pension or annuity income, deferred compensation, income from certain partnerships, and any amount you exclude from income. The last piece includes gifts. Refer to IRS Pub 590, Table 1-1 (link) for more info.

For your children, if they have a job where they receive a paycheck, this qualifies.

Compelling Factors

There are several reasons a Roth IRA for kids is a great choice.

Roth contributions (not the earnings) can be withdrawn at any time without tax or penalties. This provides incredible flexibility.

Roth funds can be used for college expenses, again penalty-free.

Retirement funds are not assessed against the student for college financial aid, unlike a standard checking or savings account.

Up to $10,000 in earnings can be withdrawn for a first-time house purchase. This is in addition to any contributions which can always be withdrawn.

What If My Child Doesn’t Have A Formal Job

Younger teens may not have a formal job, but if they earn money mowing lawns, shoveling snow, babysitting, etc. They could still qualify. This income would need to be reported to the IRS and you should make sure you keep good records. [Note – This isn’t tax advice so if they don’t have formal employment you should consult a tax or legal professional]

If they are using self-employment income, they may need to pay self-employment & Social Security tax. It can still make sense to use the Roth IRA in this case. Again, consult a tax professional with any questions.

So How Do I Open An Account?

Most brokers have custodial IRA accounts that parents can open for their kids. I’d check wherever you have an investment or IRA account first. Not an endorsement, but Fidelity has a Roth IRA for kids that you might want to check out if your custodian doesn’t offer it.

If you liked this article, you may want to check out this article (link) on how to increase your savings rate.